Covid-19 Crisis: New Opportunities for Microfinance Institutions

ADA(1), Inpulse(2) and the Grameen Crédit Agricole Foundation are joining forces to closely monitor and analyze the effects of the COVID-19 crisis on their partners around the world. This monitoring will be carried out periodically throughout 2020 with the aim of assessing the evolution of the effects of the crisis as well as the financial needs and adaptation measures implemented by our partners. With this regular and in-depth analysis, we hope to contribute, at our level, to the construction of strategies and solutions adapted to the needs of our stakeholders, as well as to the dissemination and exchange of information between the various actors in the sector for the joint search for global and systematic solutions.

This article is based on responses provided between May 18 and 27, 2020, by 110 partners in 47 countries across Europe, Africa, Asia, and Latin America, 5 regions (3) and 13 sub-regions of the world (4). In our analysis, we focused on very small MFIs (46 %), with less than $5 million in assets (Tier 3), medium-sized MFIs (47 %), with assets between $5 and $50 million (Tier 2), and larger MFIs (more than $50 million in assets, Tier 1) with 7%. (5)

In summary

The current situation leaves no MFI or region of the world indifferent. The COVID-19 crisis has hit most microfinance businesses at their core. All of the institutions surveyed are facing common issues due to the crisis: difficulties with disbursements, collections, and client meetings, among others. These deeply operational activities, closely linked to client contact and meetings, have financial consequences for MFIs. Portfolio management and risk management are the short-term challenges posed by the crisis, according to more than 80% of our partners.

However, marked regional differences emerge from this research. The constantly evolving health crisis does not have the same consequences in all regions of the world, nor the same intensity. On the operational side, for example, the difficulties or impossibility of collecting savings is not an issue for everyone. This concerns 55% of the MFIs surveyed in Sub-Saharan Africa and 60% of those in South Asia, while the subject is rarely or not at all discussed in other regions. This depends in particular on the constitution of the local market, and the capacity of institutions to offer this product to their clients, depending on the legislation in force. Regarding the constraints posed by the crisis, we note that a high proportion of MFIs in Latin and Central America, as well as in Central Asia and the MENA region, report that employees are finding it difficult to travel or meet clients in branches, unlike MFIs in Southeast Asia or Sub-Saharan Africa.

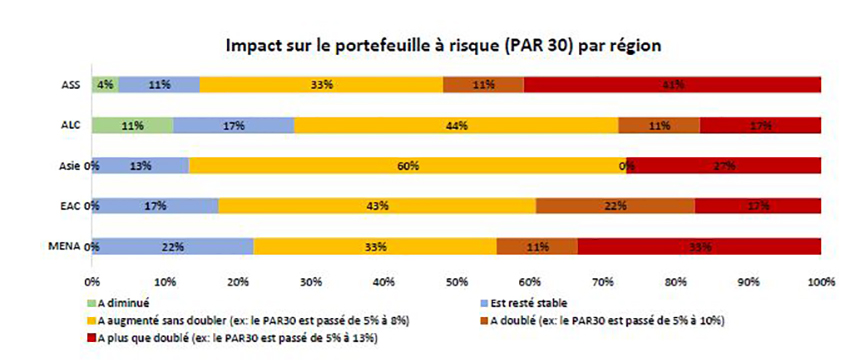

The portfolio at risk is also impacted in different ways depending on the region. Thus, only 17% of MFIs in Central Asia and Europe and Central and Latin America have observed a PAR 30 + R that has more than doubled, while this concerns 41% of MFIs in Sub-Saharan Africa, 27% of those in South Asia and 33% of those in the MENA region. These regions are not left out, however, since they still report an increase in PAR 30 + R. Thus, at the global level, 80% of respondents indicate a deterioration in portfolio quality, which therefore represents a challenge for all MFIs in the short and medium term.

To address these issues, MFI needs also vary. While 60% of respondents expressed additional financing needs, this is less the case for the Europe and Central Asia region. Indeed, 57% of MFIs in this region indicate that they have no additional needs, and 22% consider that their needs have decreased. In contrast, approximately 30% of institutions in the MENA, Sub-Saharan Africa, and Latin and Central America regions see their financing needs as 20% and 50% above what they had anticipated.

The information gathered, however, demonstrates the proactivity of MFIs in the face of the crisis. Across the world, they have made numerous adjustments to adapt to the crisis. Between dedicated committees, continuity plans, and discussions between all stakeholders, institutions have chosen not to remain silent in the face of the consequences of the crisis. Finally, beyond the current economic difficulties, the discussions conducted by most of our partners are also geared toward new opportunities for the future, such as targeting new markets or developing new products. This could contribute to greater flexibility for our partners in the future, although this remains to be confirmed.

The impact of the COVID-19 crisis on the microfinance sector: the perspective of different MFIs around the world

The severity of lockdown measures continues to vary by country. 44% of respondents reported that their country is in almost complete lockdown and restricted movement. 46 % of our partners, primarily those located in Sub-Saharan Africa and Latin and Central America, reported limited lockdown and partial restriction of movement. Finally, only 10 % of our partners, primarily located in Latin America, reported no or very limited lockdown measures. The context in each region is different and largely, or entirely, determined by the actions established by local government authorities. While Europe and Central Asia appear to have greater uniformity in lockdown measures, the situation is not the same in Latin America, where restrictive lockdown measures have been established in some countries while in others, this type of measure has not yet been considered.

Another important aspect to consider is the fact that the development of the pandemic has been gradual in different regions of the world. At the end of 2019, the virus was widespread in China. By March it had been brought under control in Asia, while at the same time, Europe became the new epicenter of the pandemic and the World Health Organization (WHO) declared the virus a “global pandemic”(6). Currently, America and Africa are heavily affected. The evolution of the pandemic in different regions of the world also significantly determines the type of responses provided by our partners, their level of affectation and most certainly the evolution of some of their most relevant indicators. Trends to which we will pay attention in our future investigations and analyses.

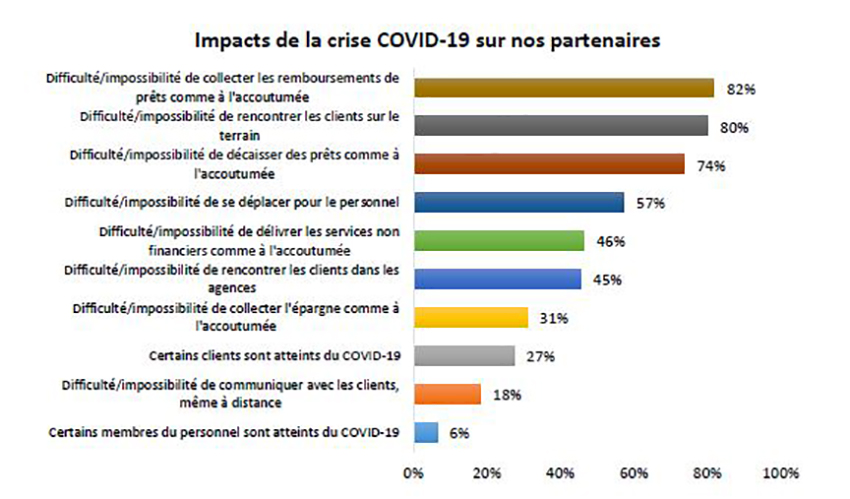

The COVID-19 crisis has caused a significant slowdown, or even an impossibility, in carrying out the essential activities of our partners.

82% of our partners reported having difficulty or being unable to collect loan repayments in the usual manner. This difficulty appears to impact partners in all regions, but especially those in the MENA (100%), Sub-Saharan Africa (85%), and LAC (81%) regions. The second most constraining difficulty, highlighted by 80% of our partners, is the inability to meet clients in the field. MFIs in the MENA region continue to be the most affected (100%), followed by those located in the EAC (91%) and LAC (81%) regions. The third difficulty, expressed by 74% of our partners, concerns loan disbursements. This difficulty is a little more exacerbated among partners located in the MENA (89% of partners in the zone), LAC (81%) and SSA (78%) regions.

On the other hand, for 94% of our partners, communication with clients does not seem to pose any particular problem during these times. This may be due, as detailed below, to the significant use of digital systems and digital technologies for remote communication. Similarly, 94% of the MFIs reported that their employees were not infected with the COVID-19 virus, which represents a very satisfactory result of the measures taken at the beginning of the crisis by our partners to protect their staff(7).

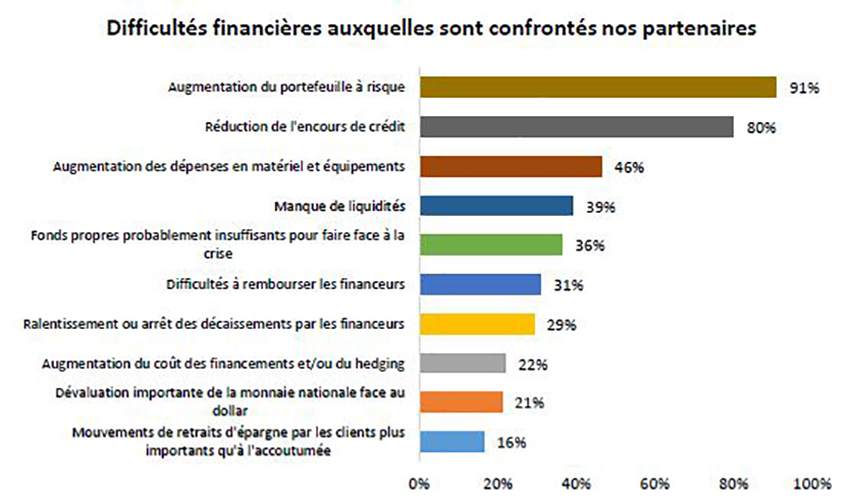

MFIs have experienced various financial difficulties due to COVID-19

For 91% of our partners, the increase in portfolio at risk is the greatest financial difficulty they have had to face due to the pandemic. This is a difficulty reported in all regions and by MFIs of all sizes, but it concerns 100TP3T of partners located in the MENA region, 93TP3T of those present in SSA and Asia, and 9% and 86% of those located in the EAC and LAC regions, respectively. The exceptional reduction in portfolio is also a major difficulty for 80% of our partners. This observation is mainly made for 93% of MFIs located in the SSA region and 86% of those present in LAC. The increase in the cost of materials and equipment and the lack of liquidity were difficulties encountered by 46% and 39% of the partners, respectively.

“We believe we may not have enough funds for disbursements by the end of June if the situation on the ground improves” – Partner in South Asia

PAR 30 is already, at this stage, a major concern

80 of our partners reported that their PAR 30 increased due to the COVID-19 crisis. Specifically, for 12 partners, it doubled, and for 25 partners, PAR 30 more than doubled. For 43 partners, it increased without doubling. Partners located primarily in Asia, the Americas, and Central Asia and Europe reported that their PAR 30 increased without doubling, while most partners in Africa reported a more than doubled PAR 30 increase, followed by partners in the MENA region.

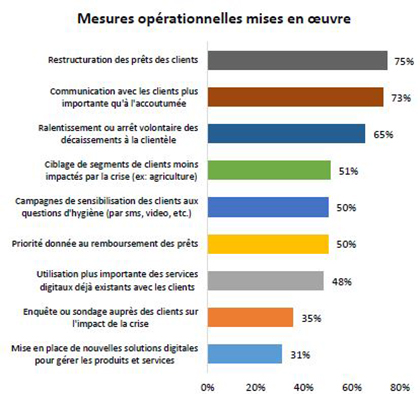

Crisis mitigation strategies: from credit restructuring to the use of technological means

Our partners are implementing various financial measures and operations to mitigate and adapt to the effects of the crisis. 75% of them, mainly those located in Asia (87%), have undertaken the restructuring of their clients' loans. Similarly, 65% of our partners have slowed down or stopped loan disbursements. This measure was mainly implemented by partners located in the LAC region (78%) and was much less popular in the MENA region (44 %).

“Analysis of rescheduling requests in order to be able to support customers with emergency loans, but it is on a case-by-case basis” – Partner in West Africa

Another relevant strategy is directing loans to clients in sectors less affected by the crisis, such as agriculture. This is a measure cited by 51% of respondents, primarily those located in Africa and Central Asia. However, 50% of respondents say they prioritize loan repayment.

Another relevant strategy is directing loans to clients in sectors less affected by the crisis, such as agriculture. This is a measure cited by 51% of respondents, primarily those located in Africa and Central Asia. However, 50% of respondents say they prioritize loan repayment.

Additionally, customer communication is a priority strategy for our partners. 73% of them have improved customer communication during this period, and 50% have launched a hygiene awareness campaign for customers, whether via SMS, video, etc.

Finally, it should be noted that technology is an important tool in addressing the crisis. Partners are using existing digital solutions (48%) or new solutions (31%) for communicating with customers and managing financial products and services.

“We intend to improve the use of digital approaches for service delivery, help clients market their products and diversify their businesses (…)” – Partner in South Asia

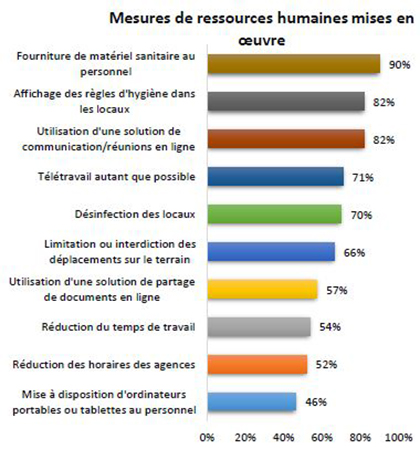

Human resource management strategies: from hygiene measures to the use of technological means

90% of the partners provided their staff with sanitary equipment. Additional hygiene measures in offices and disinfection were taken by 82% and 70% of the surveyed partners, respectively. The organization of working hours and field travel is indicated as another measure of great importance for MFIs to combat the health crisis. 71% of the partners, mainly those located in the MENA, LAC, and Asia regions, implemented teleworking as much as possible. Similarly, 66% of the partners restricted or prohibited field travel for their teams. Finally, 54% of the surveyed MFIs, mainly located in the MENA region and the Americas, reduced working hours, and 52% of them reduced customer service hours in branches.

The use of digital technology to maintain communication and the ability for employees to work is also relevant in this context, according to our information. Thus, 82% of MFIs use virtual meeting solutions and 57% use an online document sharing solution (mainly those in the MENA and LAC regions). In addition, 46% of respondents have provided their employees with laptops or tablets (especially in the MENA region, up to 78 %).

“We set up two WhatsApp communication groups with the staff, one for Sinhala and one for Tamil. Then, we had regular communication with them during the lockdown.” – Partner in South Asia

Crisis management measures

Our partners can be considered to have implemented two main types of measures to manage the COVID-19 crisis effectively. The first group of measures concerns the development of internal actions for analyzing and monitoring the effects of the crisis: 78% of partners have set up an ad hoc monitoring management committee. These measures were particularly prioritized for partners in the SSA and MENA regions. 75% of partners, mainly those located in Asia and Sub-Saharan Africa, have prepared a business continuity plan. 74% of partners, mainly those in the EAC and MENA regions, have updated their liquidity plan. In addition, 65% of respondents have carried out a worst-case scenario simulation, this approach being implemented more in the MENA region than in Africa.

The second group of measures includes measures aimed at requesting support from third-party entities. 53 partners, particularly those located in the MENA and LAC regions, requested financial support from donors and their financial partners. 52 partners, particularly those located in the MENA region, also negotiated with lenders to arrange loan repayments. In addition, 37 partners, particularly those located in Asia and sub-Saharan Africa, requested technical assistance support from donors and partners. These three approaches were less developed by partners located in the EAC region, whose request for technical assistance was less prominent.

30 of our % partners reported that they had no additional funding needs, and 12 %s indicated that their needs had decreased since the beginning of the crisis. These responses came primarily from partners located in the EAC region.

On the contrary, 58% of the partners indicated that they would need financing for amounts greater than their forecasts. Among them, 28%, mainly those located in Asia and the MENA region, stated that they would need additional funds, between 0% and 20% of their budget. 24%, and mainly those present in the MENA region, stated that they would need 20% to 50% of additional funds. Finally, 6% of the MFIs, particularly those located in Asia, stated that their needs exceed 50% of the forecasted amounts.

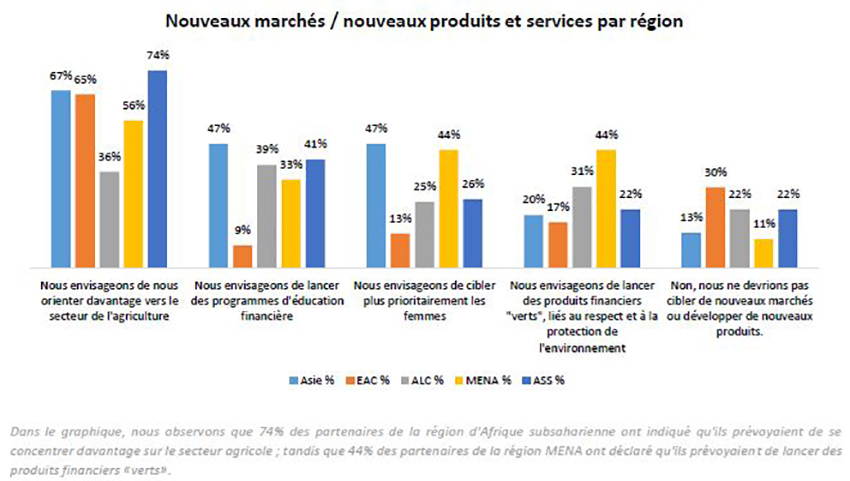

Future prospects: new markets and new products

At this stage, a majority of our partners (57%), have expressed their interest in focusing more of their activities towards the agricultural sector. This hypothesis is particularly raised by partners in the Africa, Asia and EAC regions. This may be due both to the increase in client needs in this sector, or to its identification as one of the sectors of activity least affected by the COVID-19 crisis (aspects already considered in the articles developed by Inpulse and the Grameen Crédit Agricole Foundation)(8). This hypothesis will be important to study in our future work since the agricultural sector represents economic, social and environmental issues, such as the concentration of a significant part of our partners' portfolio, but also job creation in certain countries and a potentially negative interaction with ongoing climate change.

Finally, on the other hand, 37 of our % partners plan to launch financial education programs and 27 % plan to focus more on women as clients.

“We plan to promote digital education for female clients (digital culture)” – Partner in South America

These are traditionally addressed sectors in the microfinance sector. However, it should be noted that 25% of our partners have also expressed interest in launching “green” financial products, linked to environmental protection. This interest could demonstrate our partners’ increased awareness of the environmental issues related to their actions. We wonder if this represents a strengthening of green microfinance due to the COVID crisis. Finally, it remains to be seen what type of green products our partners would target in the coming months. These questions will be relevant to our future work.

On the other hand, launching microinsurance products related to hygiene, death risk, health, or environmental risks does not seem relevant to our partners. Furthermore, 22% of respondents indicated that they do not plan to move into new markets or develop new products.

_____________________________________________________________________________

Leave a Reply

Want to join the discussion?Feel free to contribute!