ADA, Inpulse, and the Grameen Crédit Agricole Foundation partnered in 2020 to monitor and analyze the effects of the Covid-19 crisis on their partner microfinance institutions around the world. This monitoring was carried out periodically throughout 2020 to gain a better understanding of the crisis's international developments. We are extending this work this year, on a quarterly basis. The findings presented in this article follow the first quarter of 2021. With this regular analysis, we hope to contribute, at our level, to the development of strategies and solutions tailored to the needs of our partners, as well as to the dissemination and exchange of information between the various stakeholders in the sector.

In summary

The results presented in the following pages come from the sixth survey in the joint series (1) of ADA, Inpulse and the Grameen Crédit Agricole Foundation. The responses from our partner microfinance institutions were collected during the second half of April 2021. The 87 responding institutions are located in 47 countries in Eastern Europe and Central Asia (EAC-25%), Sub-Saharan Africa (SSA-29%), Latin America and the Caribbean (LAC-25%), South and Southeast Asia (SSEA-13%) and the Middle East and North Africa (MENA-8%) (2).

While the general improvement in local contexts related to COVID-19 is enabling microfinance institutions to better conduct their activities, our latest survey shows that MFIs nevertheless had considerable difficulty achieving their development objectives in the first quarter of 2021. The reasons given are mainly linked to the difficulties encountered by MFI clients. The latter are reluctant to commit to new loans, and if they do, it is with smaller amounts than in the past. At the same time, their risk profile has deteriorated due to the crisis, and MFIs will have more difficulty financing them.

This general trend of rising risk has materialized in a decline in the quality of MFI portfolios. In 2020, this ultimately had an impact on institutions' income statements with an increase in provisioning expenses. This will likely be the case again this year, with additional reserves but also loan write-offs.

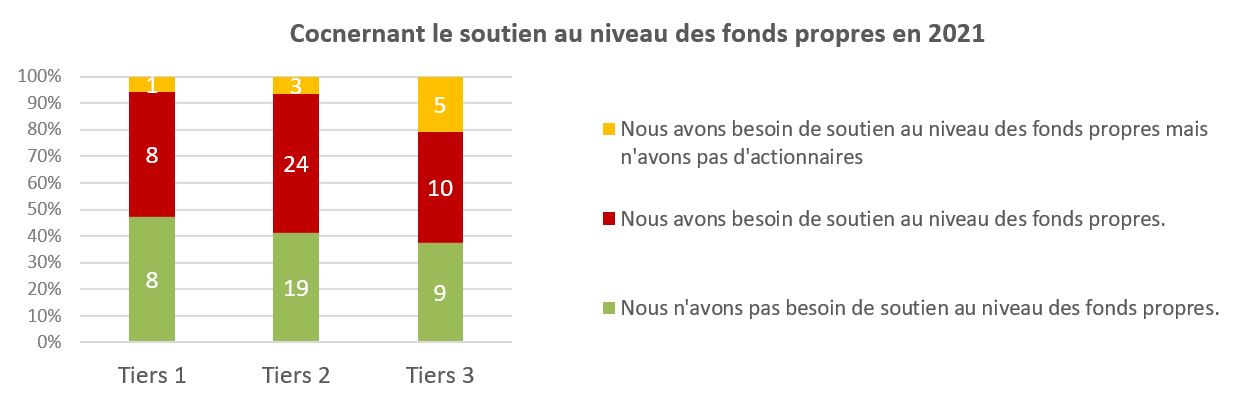

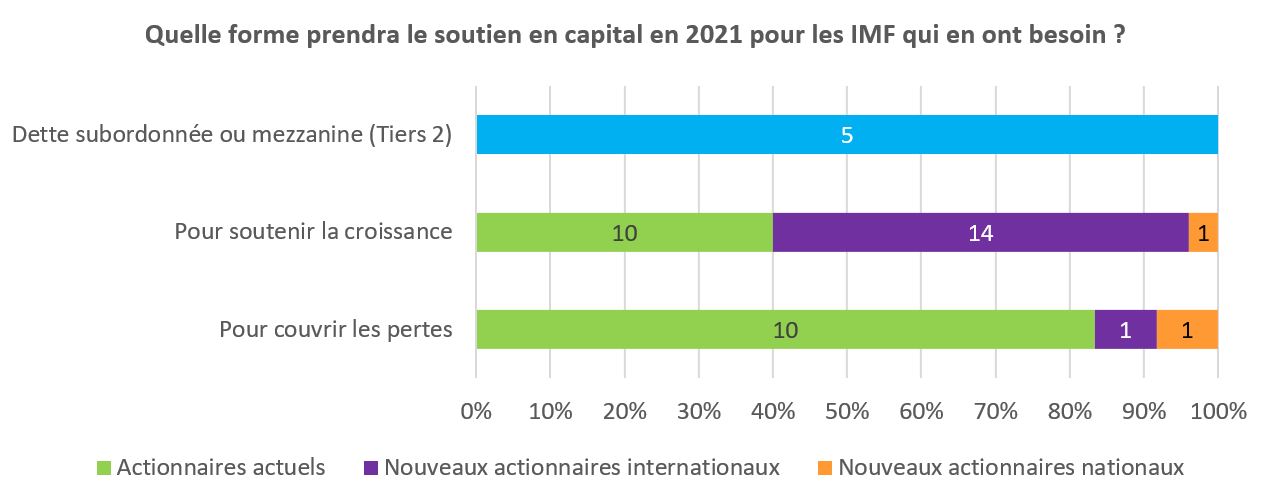

In fact, MFI operations have been reduced or slowed, generally with a decline in their capital levels. Indeed, one in two MFIs, regardless of size, reports capital needs in 2021. Two trends are emerging: MFIs are counting on their current shareholders to cover losses related to the crisis. On the other hand, international investors are expected to support their development this year. The responses from our partners therefore highlight the need for recapitalization this year, which will involve all stakeholders in the sector.

1. Despite the reduction in constraints, disbursement levels are mixed

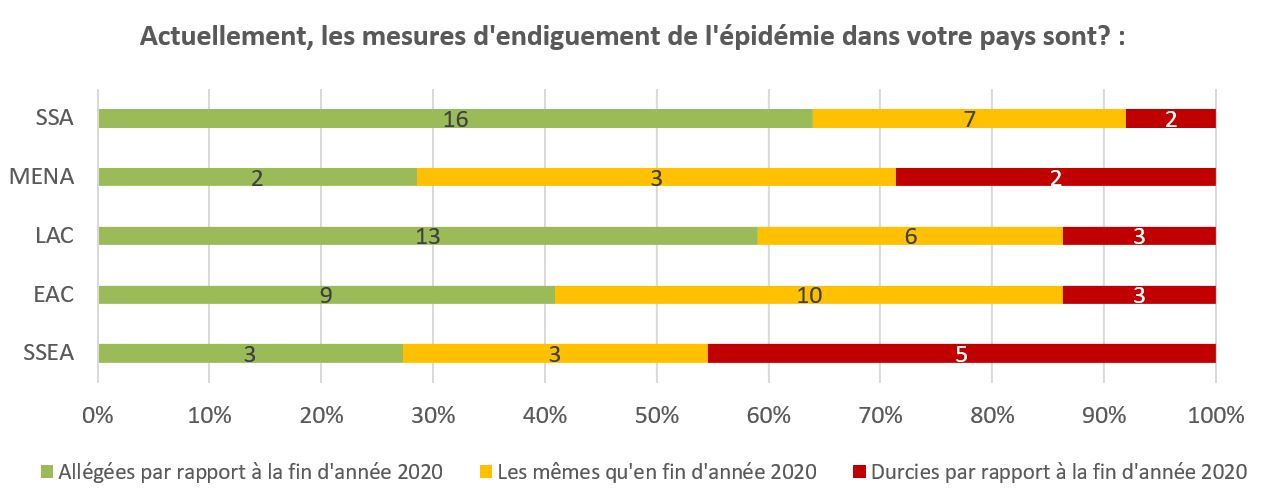

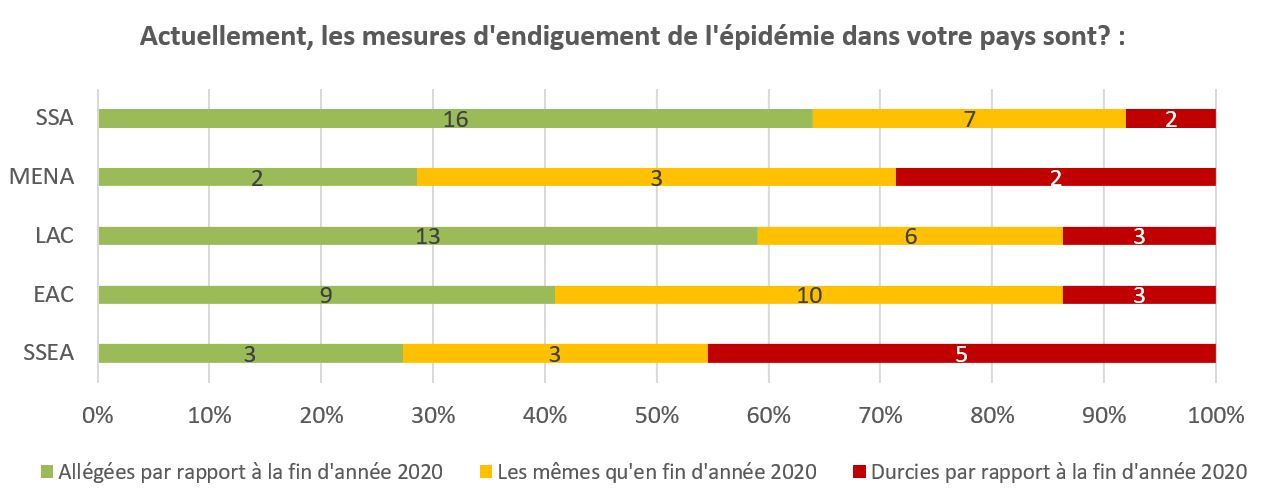

While we have been seeing a gradual but definite decline in operational constraints for MFIs since the summer of 2020, this phenomenon continues in the first quarter of 2021. In total, 50% of MFIs indicate that the measures in place in their countries are less restrictive in April compared to the end of 2020. This point is particularly marked in sub-Saharan Africa (64% of respondents in the region) and Latin America and the Caribbean (59%). This is found to a lesser extent for MFIs in Europe and Central Asia, where the situation is either improving or stable. Finally, the situation is opposite in South and Southeast Asia, with 45% of respondents in the region reporting a more difficult context, with the Cambodian and Burmese situations weighing in particular on results.

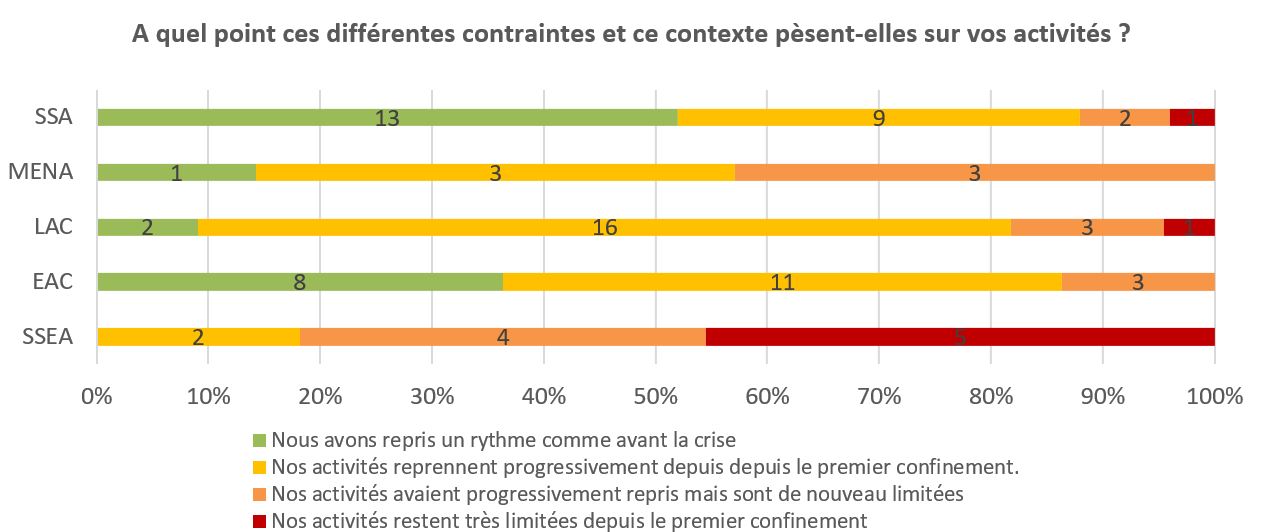

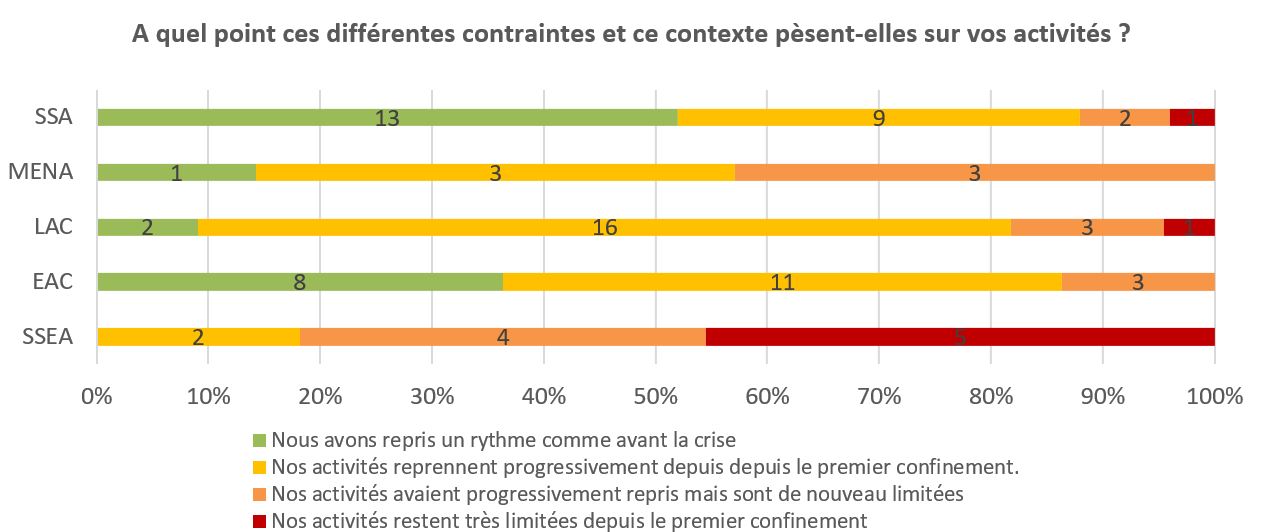

Overall, nearly half of those surveyed report no longer encountering any operational constraints in carrying out their activities. This is reflected in the resumption of MFI activity: 52% of those in sub-Saharan Africa can operate as before the crisis. In Latin America, the vast majority of them are gradually resuming activity since the first difficulties encountered. In Europe and Central Asia, the situation is again divided between gradual or almost complete recovery. Conversely, for MFIs in the SSEA region, the deteriorating context is materializing in activities that are either still constrained or once again affected by new measures to contain the epidemic.

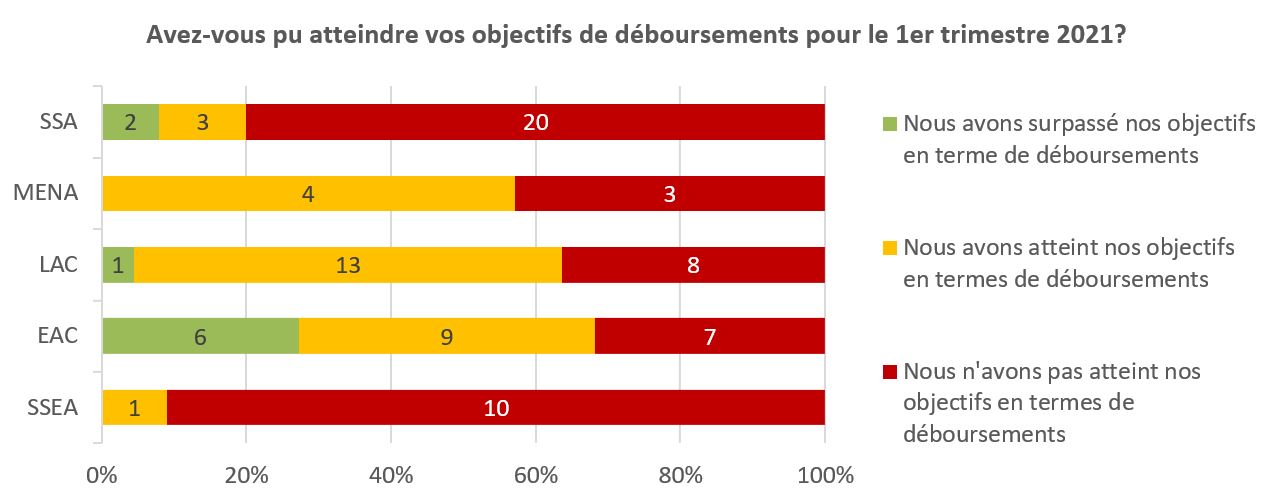

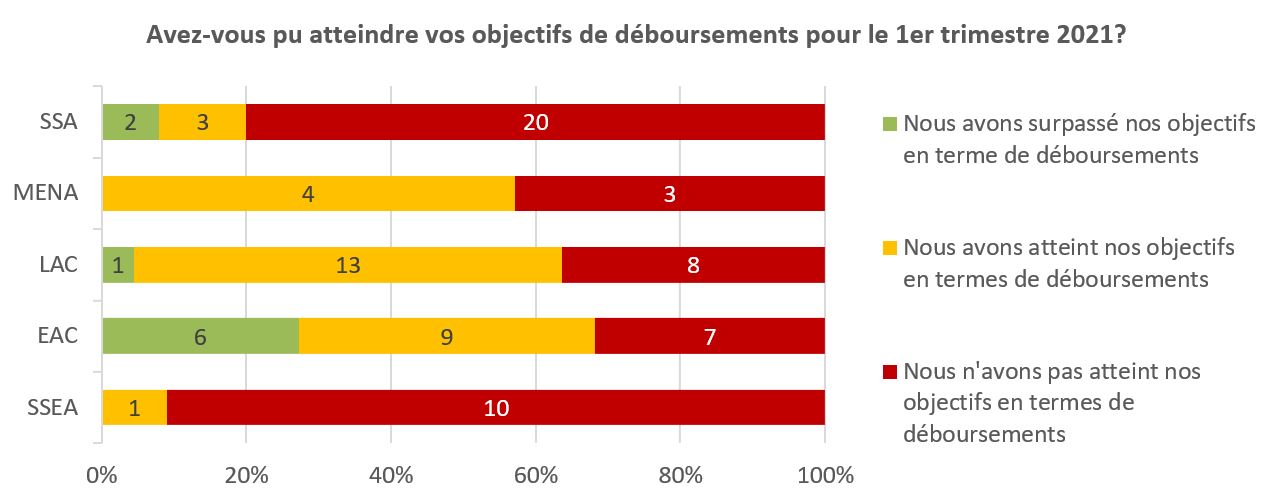

Despite these continued positive signals regarding our partners' activity levels, it appears that the level of loan disbursements expected for the quarter is still difficult to achieve. Thus, 55% of respondents indicate that they did not meet their loan disbursement targets in the first quarter of 2021. Only 10% of respondents exceeded their expectations, while 35% managed to meet their targets. The responses do not appear to be solely linked to the resumption of activities: for example, 80% of MFIs in sub-Saharan Africa did not meet their disbursement targets in the first quarter, while half report having resumed activity close to pre-crisis levels.

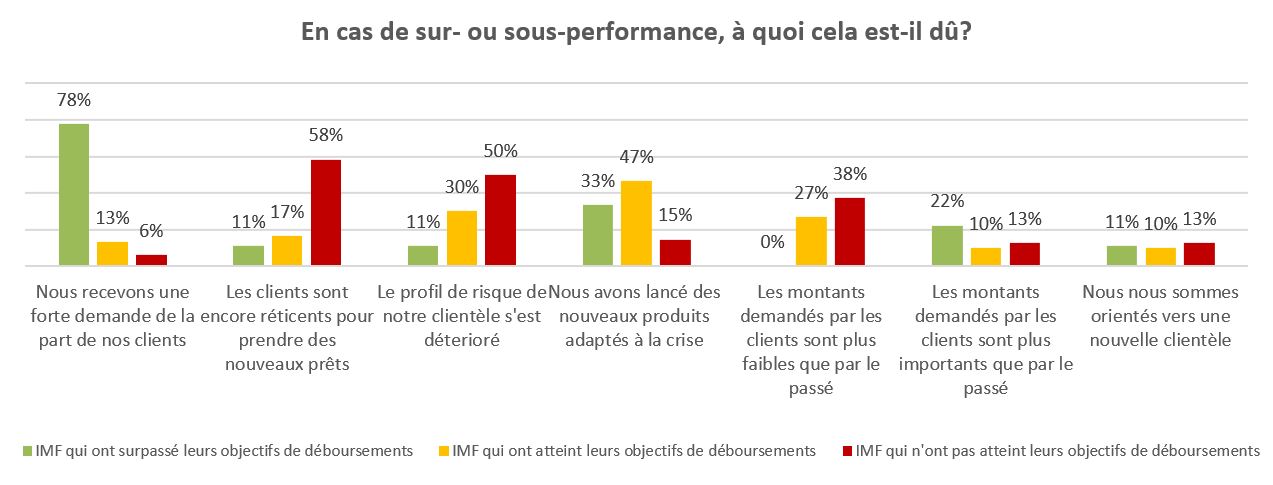

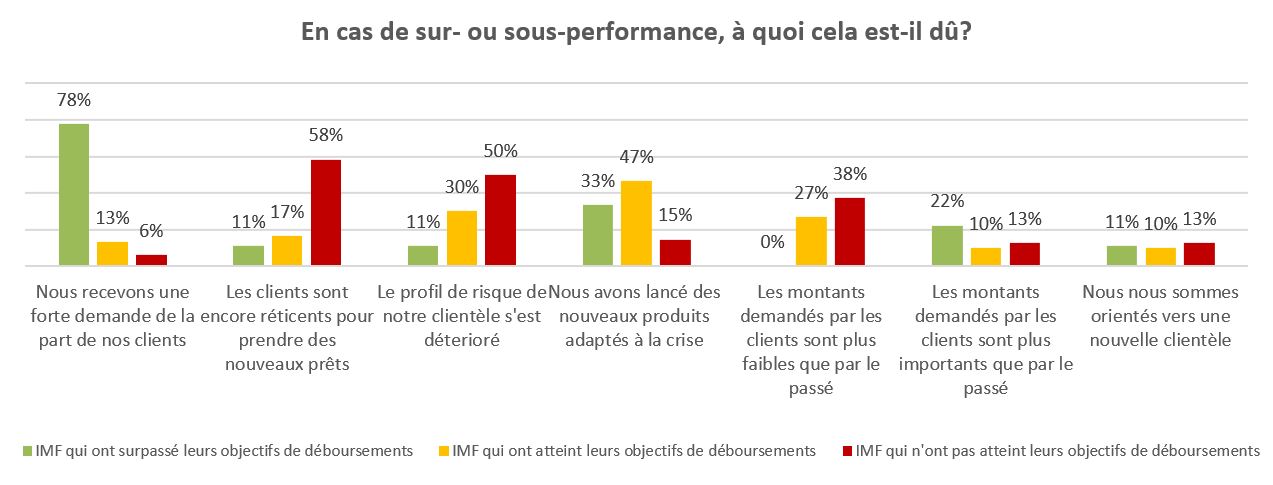

When MFIs failed to achieve their growth targets at the beginning of the year, three reasons emerged to explain this phenomenon. First, the fact that clients are still reluctant to take out new loans (58% of this group), particularly in a still rather uncertain context. Second, this is explained by the risk profile of clients that has deteriorated (50%), and who are no longer eligible for loans, or are only eligible for smaller amounts (38%).

These last two arguments are also mentioned by MFIs that have achieved their objectives without exceeding them. However, this dynamic is partly offset by the fact that institutions have adjusted to the crisis and have implemented products adapted (digital, targeted sectors, etc.) to the current contexts to meet demand (47%).

Finally, the trend is quite different for MFIs that have exceeded their disbursement targets: the main factor is the strong demand received (78%), while the adjustment of supply (33%) and the increase in the amounts requested (22%) support this trend.

2. A persistently high credit risk continues to have a significant impact on the profitability of institutions

2. A persistently high credit risk continues to have a significant impact on the profitability of institutions

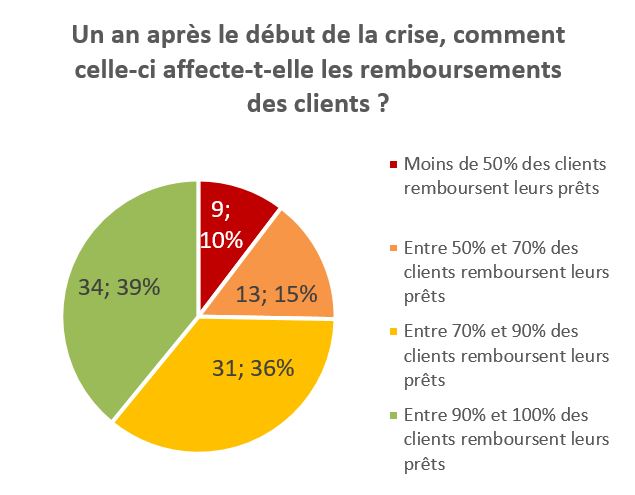

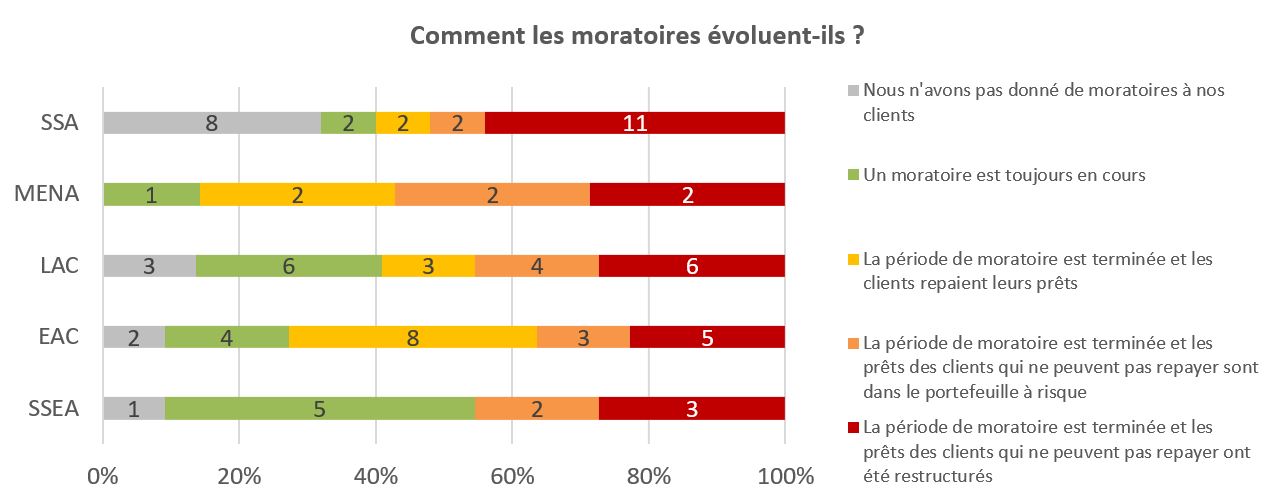

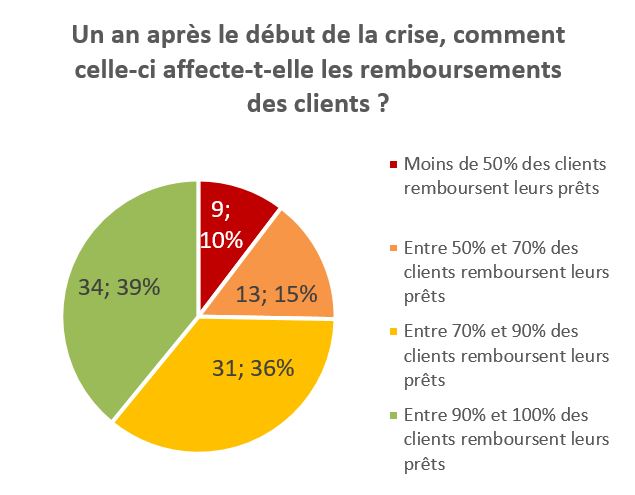

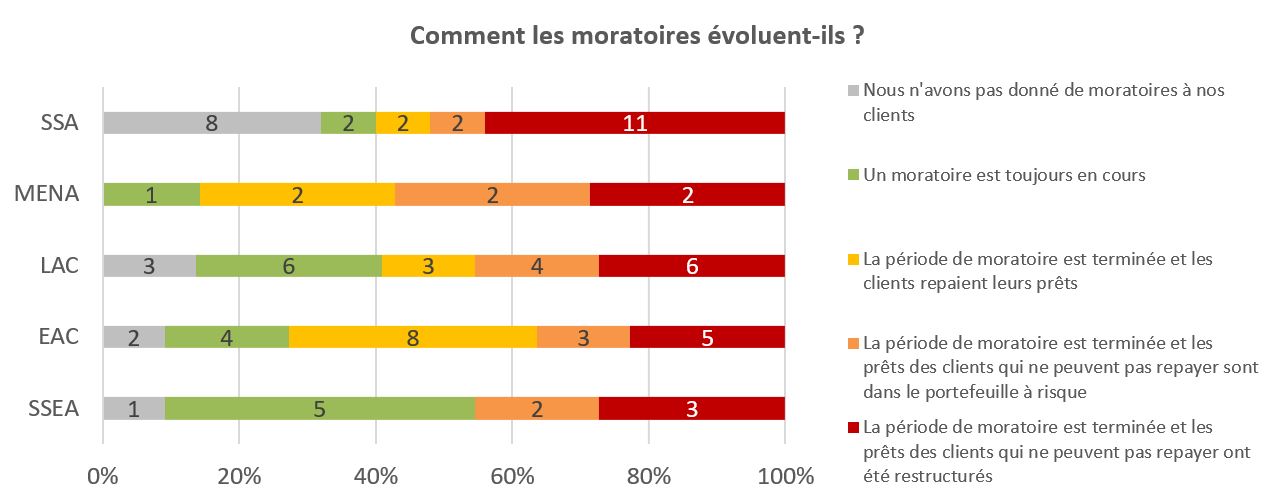

Alongside these loan disbursement issues, the issue of credit risk remains a major challenge for 64% of our partner MFIs, as we have observed since the beginning of our survey series. While late payments by clients can still stem from ongoing moratoria (20% of respondents, particularly in the South and Southeast Asia, and Latin America and the Caribbean regions), the end of the moratorium has mainly resulted in a shift from the "moratorium" portfolio to the risky portfolio, either as unpaid loans or as restructured loans. In total, 61% of respondents indicate that fewer than 90% of their clients are repaying their loans, and 25% are affected by repayment rates lower than 70%.

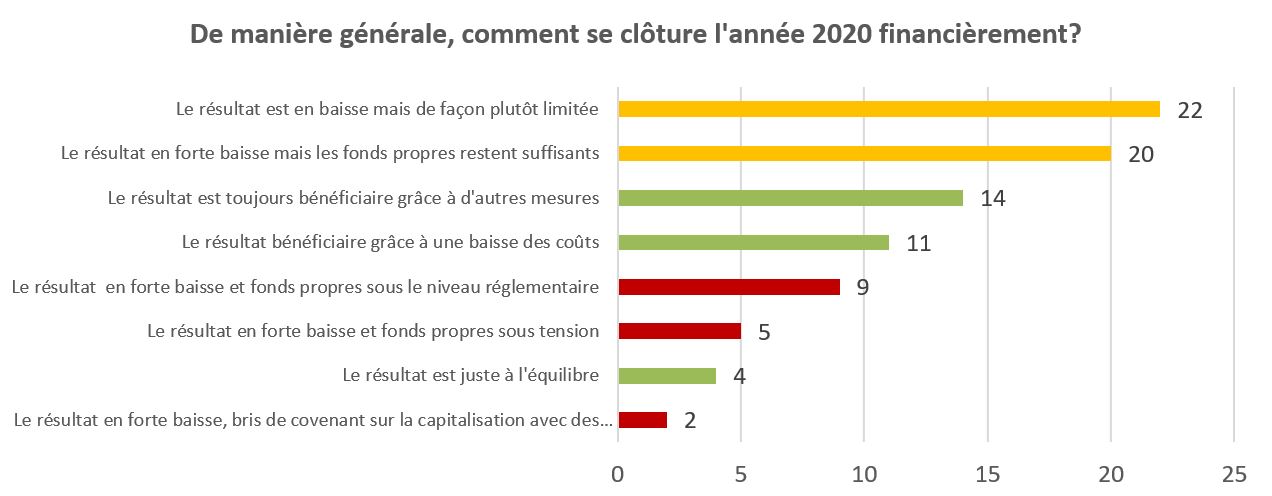

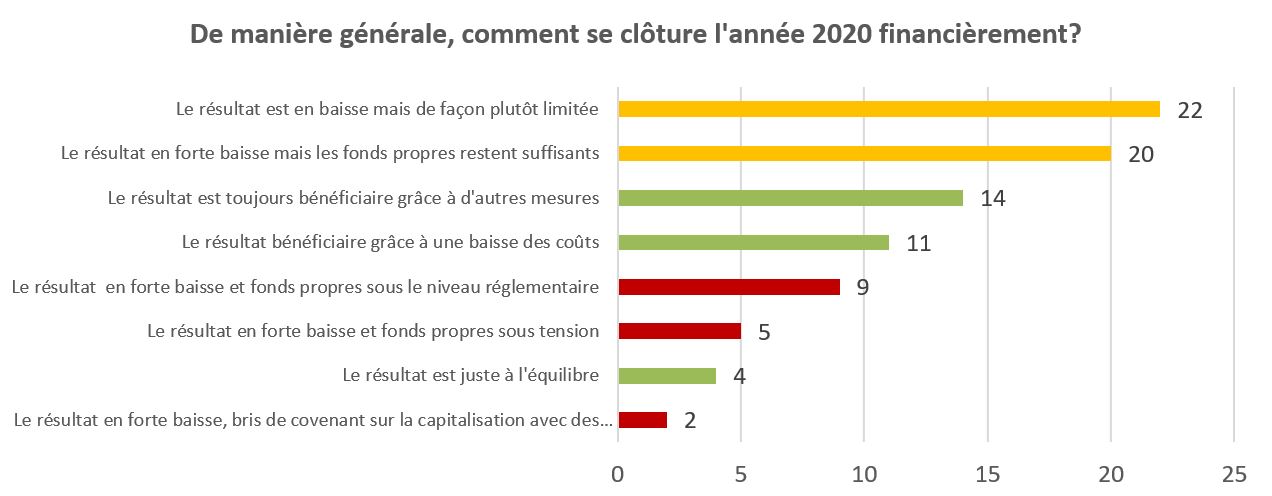

Another major challenge is the decline in MFI profitability since the start of the COVID-19 crisis. At the end of Q1 2021, 55% of our partners raised this point. In detail, we discover that a proportion of respondents managed to maintain a certain profitability in 2020, thanks to certain measures (33% – indicated in green in the graph below). We then find a group of institutions (49% – indicated in orange) for which an impact on profitability was felt, but without endangering the institution. Finally, a last group stands out (18% – indicated in red), in a less favorable position since the losses incurred in 2020 have direct consequences on the institutions' equity. Among these, this even implies for some that the company's capital falls below the minimum levels required by the regulator or financiers.

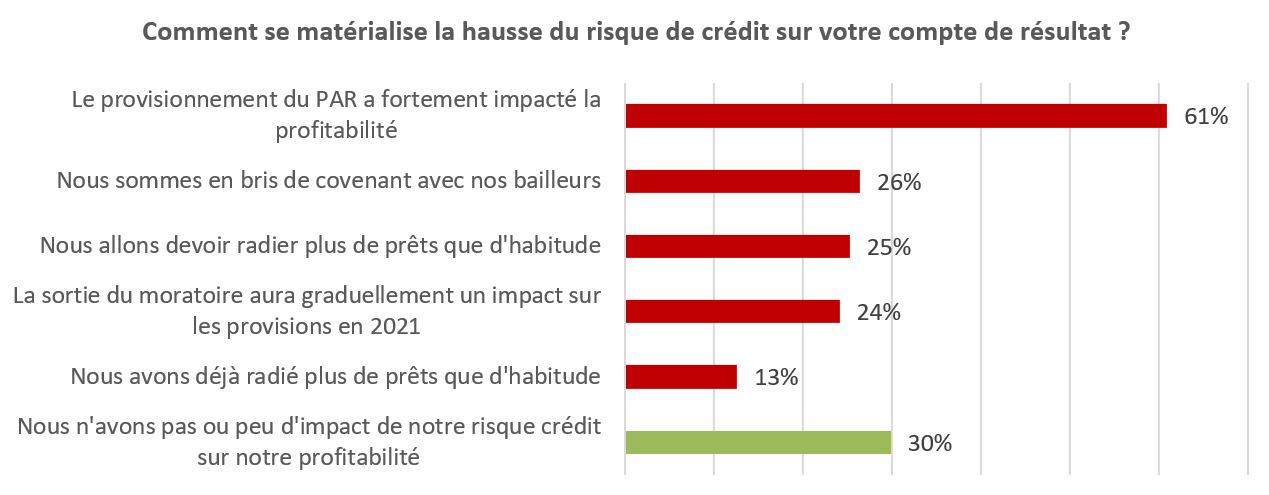

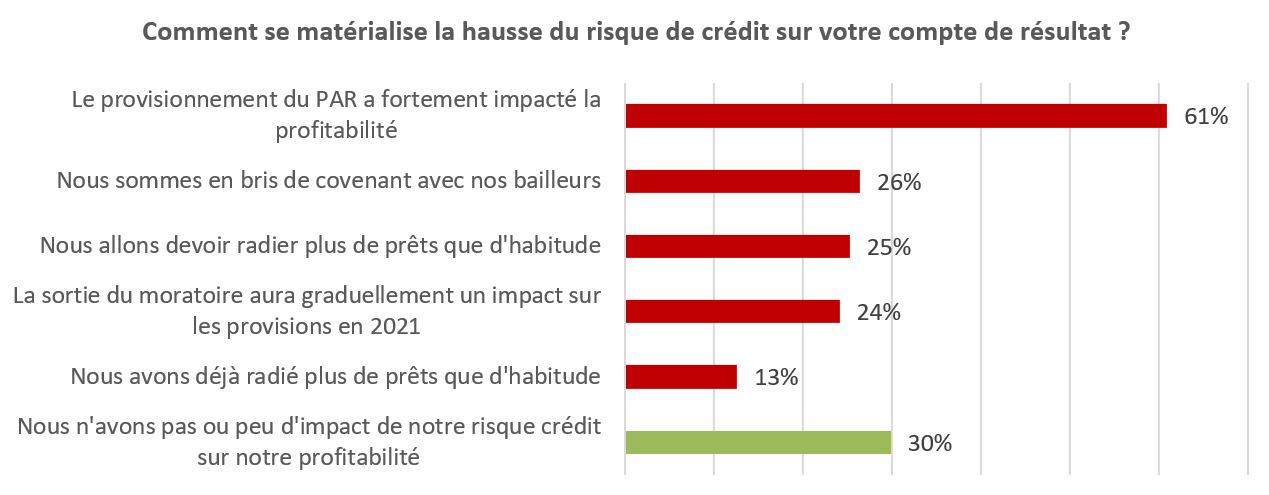

The provisioning of the risk portfolio actually emerges as the main factor impacting profitability (61%). This may have led to a breach of contractual commitments with its lenders for some institutions (26%). At the same time, there are still few massive loan write-offs, since only 13% of those surveyed have already resorted to debt cancellation to a greater extent than in previous years.

However, the impact of credit risk on MFI profitability is expected to continue in the coming months. Loan write-offs in large proportions, above usual standards, are expected to affect 25% of our surveyed partners. At the same time, 24% anticipate that PAR provisioning, particularly through the moratorium exit, will continue to have significant consequences on their financial results. Finally, it should be noted that the aging of the current risk portfolio could also lead to additional provisioning expenses.

3. Strained equity leads to search for investors

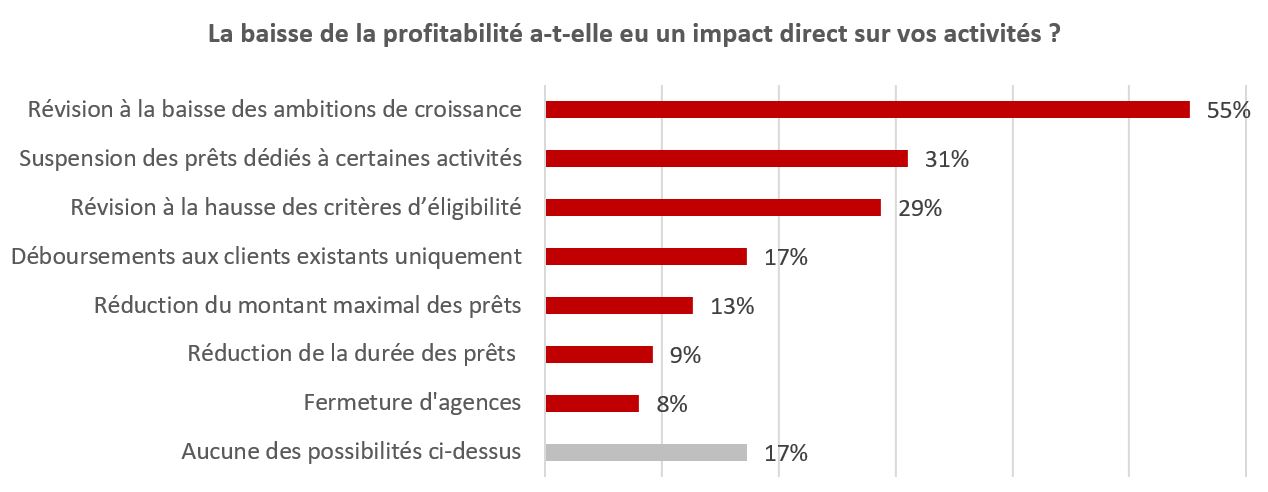

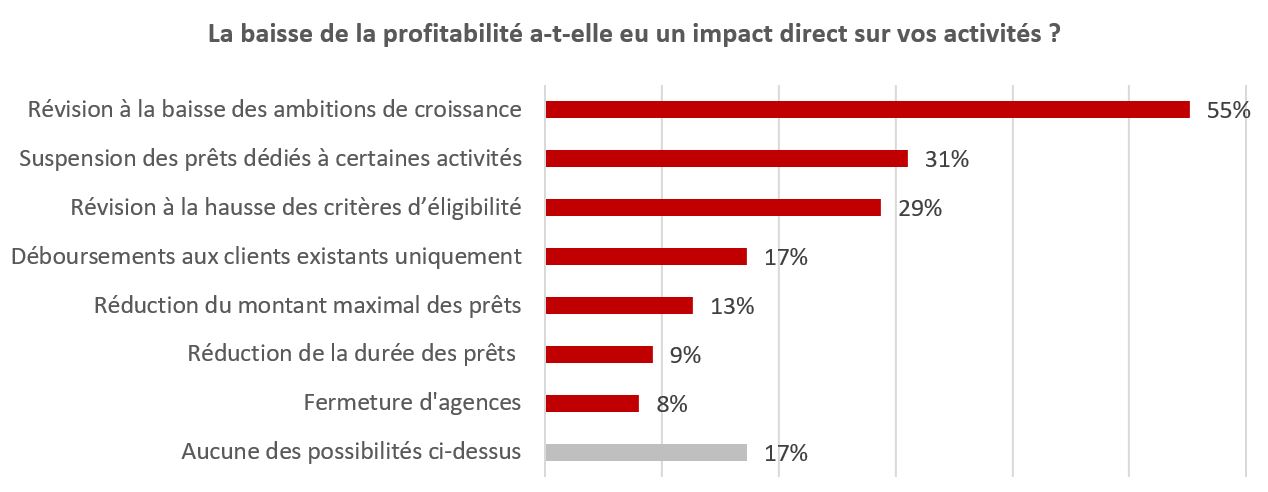

The decline in profitability, which could therefore continue in the near future without any improvement in credit risk, must be analyzed in both the short and long term. In the short term, controlling the risky portfolio is a major challenge to avoid a (further) deterioration in profitability. This then has a direct impact on MFI operations. According to our partners, this observation has in fact led to a downward revision of growth projections (55%) for the coming years. It also appears that risk management requires particular attention to the type of client activity (31% have suspended disbursements to certain sectors – often tourism, international trade, etc.) and to eligibility criteria (29%). This increased caution reflects the current emphasis on risk management.

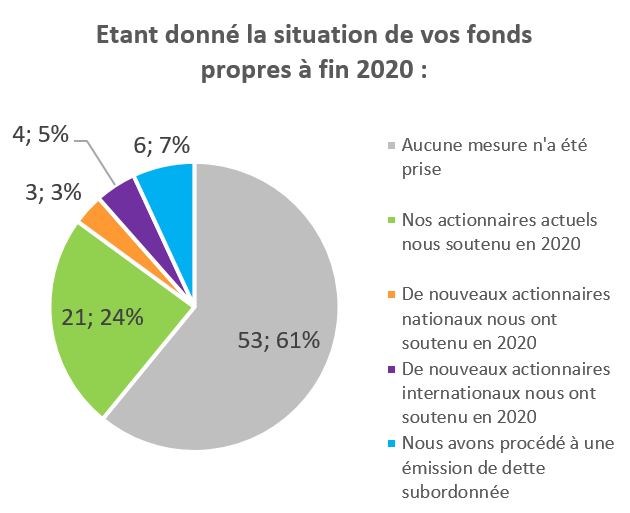

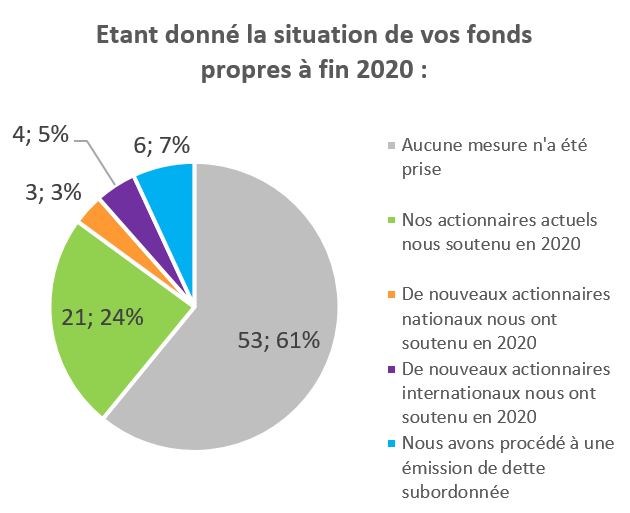

The other, longer-term perspective raises the question of the solvency of microfinance institutions in the face of declining revenues or losses. Currently, a majority of institutions (61%) have not taken any action regarding their equity since the beginning of the crisis. When this was the case, existing shareholders provided support to MFIs, while subordinated debt (tier 2 equity) was also implemented, to a lesser extent.

The other, longer-term perspective raises the question of the solvency of microfinance institutions in the face of declining revenues or losses. Currently, a majority of institutions (61%) have not taken any action regarding their equity since the beginning of the crisis. When this was the case, existing shareholders provided support to MFIs, while subordinated debt (tier 2 equity) was also implemented, to a lesser extent.

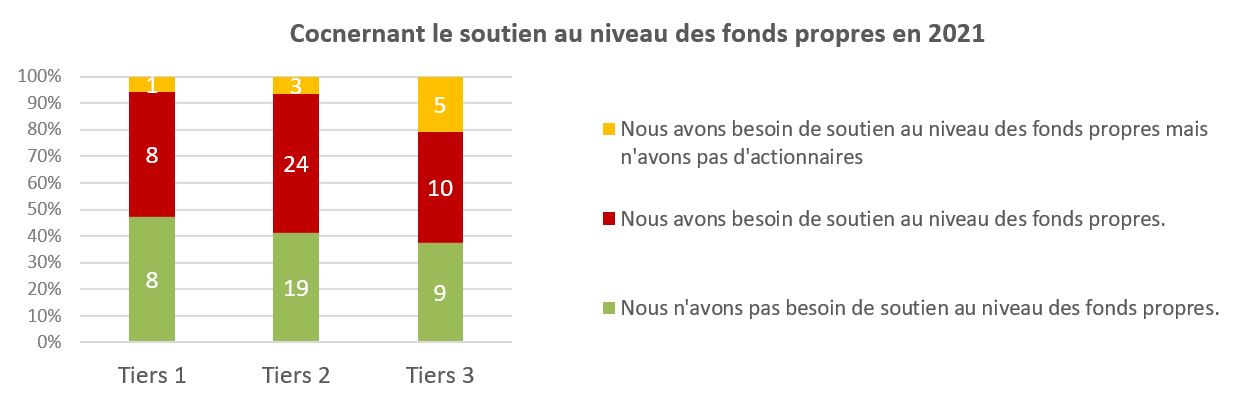

However, a very large proportion of these institutions (48%) reported a need for equity capital in 2021. This significant proportion reflects the extent of support needed within the sector to ensure its development. Moreover, there is no real archetype of the MFI that highlights this expectation of support for the balance sheet in 2021: regardless of the size of the MFIs, approximately half of each category of Third Parties expresses capital needs.

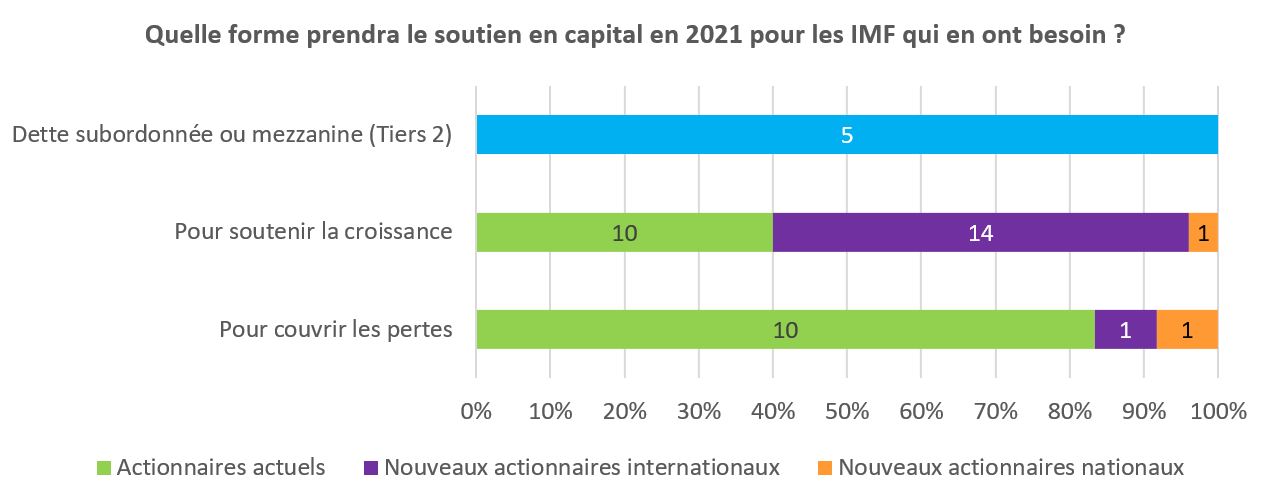

To meet these capital expectations, the types of shareholders microfinance institutions wish to turn to depend on the reason why this support is necessary. Thus, regarding the institutions mentioning a need for support at the 2021 equity level, we note that when the MFI needs help to cover losses, it then turns overwhelmingly to its existing shareholders (83% of cases, 10/12). On the other hand, when MFIs seek support to continue to develop, they will then call more on international investors (56% of cases, 14/25), beyond the potential contribution of existing shareholders. Finally, note that subordinated debt may be favored over a capital injection, this option being mentioned by 5 institutions.

All of our partners' responses therefore suggest that the impact of the crisis, through credit risk, logically creates capital needs for a large proportion of entities, since they are facing either financial losses or a limitation of their recovery capacity. While 41% of those surveyed say they want to focus primarily on improving portfolio quality this year, our partners here reiterate the essential role that international and current investors will have to play in maintaining a satisfactory level of capitalization conducive to their development.

_______________________________________________________

(1) The results of the first five surveys are available here: //www.gca-foundation.org/observatoire-covid-19/, //www.ada-microfinance.org/fr/crise-du-covid-19/ And //www.inpulse.coop/news-and-media/

(2) Number of responding MFIs by region: EAC 22 MFIs; SSA 25 MFIs; LAC 22 MFIs; SSEA 11 MFIs; MENA: 7 MFIs.

(3) Tier 1 means that the MFI manages a portfolio greater than $50 million, Tier 2 applies to portfolios of $5 million to $50 million, and Tier 3 applies to portfolios less than $5 million.

2. A persistently high credit risk continues to have a significant impact on the profitability of institutions

2. A persistently high credit risk continues to have a significant impact on the profitability of institutions

The other, longer-term perspective raises the question of the solvency of microfinance institutions in the face of declining revenues or losses. Currently, a majority of institutions (61%) have not taken any action regarding their equity since the beginning of the crisis. When this was the case, existing shareholders provided support to MFIs, while subordinated debt (tier 2 equity) was also implemented, to a lesser extent.

The other, longer-term perspective raises the question of the solvency of microfinance institutions in the face of declining revenues or losses. Currently, a majority of institutions (61%) have not taken any action regarding their equity since the beginning of the crisis. When this was the case, existing shareholders provided support to MFIs, while subordinated debt (tier 2 equity) was also implemented, to a lesser extent.