ADA, Inpulse, and the Grameen Crédit Agricole Foundation have partnered to monitor and analyze the effects of the Covid-19 crisis on their partner microfinance institutions around the world. This monitoring is carried out periodically and will continue throughout 2020 to gain a better understanding of how the situation is evolving. With this regular and in-depth analysis, we hope to contribute, at our level, to the development of strategies and solutions tailored to the needs of our partners, as well as to the dissemination and exchange of information between the various stakeholders in the sector.(1)

In summary

This article is based on responses provided between July 23 and August 6, 2020, by 91 partners in 42 countries across Europe, Africa, Asia, and Latin America (2). Feedback from microfinance institutions (MFIs) shows the continued evolution of the COVID-19 health crisis. While measures to reopen countries and restart the economy increased during the month of July, the health impact of the crisis was mentioned more significantly by our partners, whose clients and employees are ultimately also directly affected.

It is in this uncertain yet evolving context that MFIs have been braving the challenges they have faced for more than a quarter now. With operational difficulties still present, institutions remain vigilant about their portfolios and the risk they carry, which appears to have generally stabilized, albeit at a much higher level than before the crisis. Nevertheless, there are some encouraging signs regarding other issues. Thus, the vast majority of MFIs believe they can survive this crisis without undergoing major strategic changes. It also appears that the issue of liquidity has been managed rather well since the beginning of the crisis.

The battle against the virus is not yet won, however, and its repercussions are particularly strong on the informal sector of the economy. It appears that clients in the informal economy are more affected, particularly because they ultimately do not benefit from the support measures that governments can provide. However, MFIs are sensitive to these needs, and some of our partners are considering providing specific services to help their clients cope with the crisis.

1. Operational constraints still present for MFIs

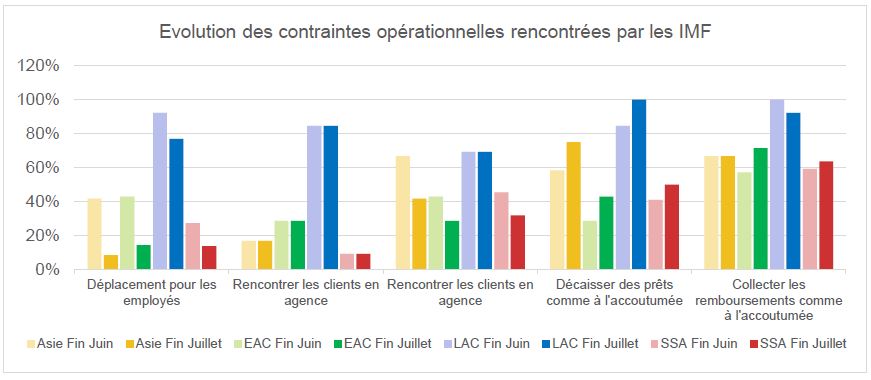

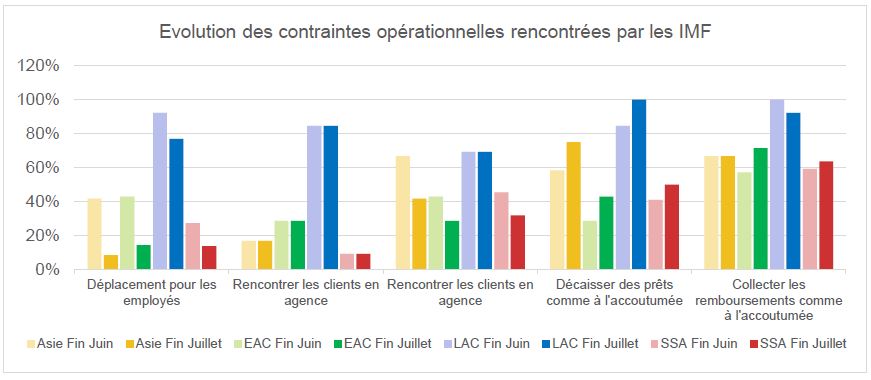

Overall, our partners are reporting further progress in terms of easing containment measures in their countries, following the initial relaxations of measures in certain regions of the world in June (notably in Eastern Europe, Central Asia and sub-Saharan Africa). Comparing the responses of our partners who responded to our survey for July and June (3) (graph below) reflects this improvement regarding operational difficulties. These results are also in line with the general results obtained for the month of July.

All MFIs report an improvement in travel options for their staff. However, this remains a major constraint in Latin America and the Caribbean, while fewer than 20% of MFIs in other regions are affected. Moreover, while freedom of movement is improving significantly in these regions, meeting clients in the field remains a significant issue for more than 30% of MFIs. Finally, with the exception of Latin America, meeting clients in branches currently appears to be the least problematic solution.

In fact, while there has been an overall improvement in client contact across all regions, collecting loan repayments or disbursing new loans at standard pre-crisis levels remains very difficult, with difficulties encountered by more than 50% of the MFIs surveyed in each region (70% and 66% overall, respectively), with some difficulties being linked to national or local regulatory constraints.

“Although other MFIs are starting to operate again, we are still waiting for permission from the regional government” – Partner in Myanmar

Especially since MFIs are still in the process of restructuring clients' loans in July (80% of respondents).

“Communication on the postponement of deadlines constitutes a brake on the repayment of credits” – Partner in Senegal

And while we have been noting for several months the singularity of the Latin American region in the responses collected due to a particularly difficult COVID-19 health context, the information obtained shows that the situation is not resolved in other regions.

And while we have been noting for several months the singularity of the Latin American region in the responses collected due to a particularly difficult COVID-19 health context, the information obtained shows that the situation is not resolved in other regions.

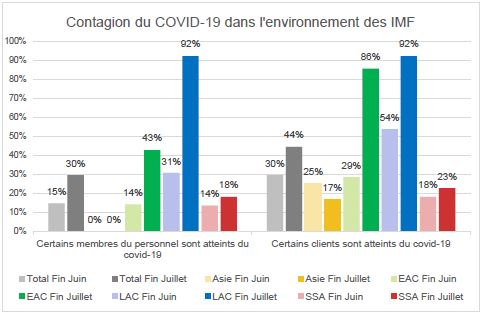

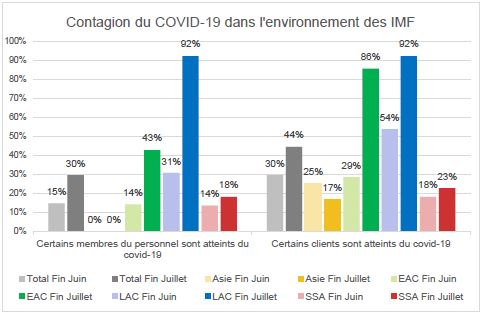

Doubts about a potential return to normal for MFI activities have not been dispelled, as the health crisis remains the central issue of the current period, and it persists. The news in July was notably marked by the occasional resurgence of cases in certain countries. This is reflected very significantly and for the first time in our surveys by a sharply rising proportion of partners who are affected by the health crisis, both among their staff and their clients (graph opposite (4)).

Thus, at the global survey level, 51% of our partners reported in July 2020 that some of their clients had contracted COVID-19, and nearly a third indicated that this also affected their employees. While we do not have data to determine the proportions of clients and staff affected respectively, this trend is nevertheless significant. More specifically, more than three out of four MFIs in Central Asia and Latin America had clients infected with the virus (one in two in June). While Latin America is largely affected on both the client and staff sides, the figures are also slightly up for staff at MFIs in Europe and Central Asia. South Asia and Sub-Saharan Africa appear to be generally more behind on this point, but the figures nevertheless encourage continued vigilance.

“More than 10 clients have died from Covid-19” – Partner in Honduras

2. MFIs continue to face major financial challenges

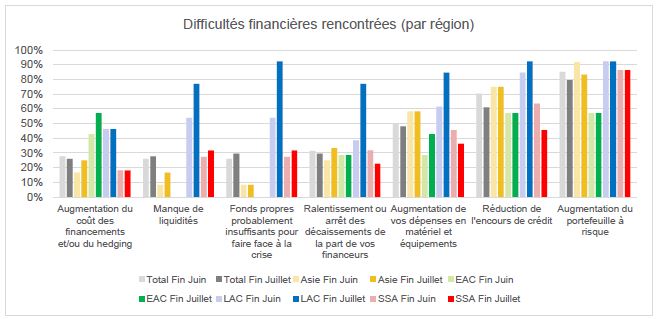

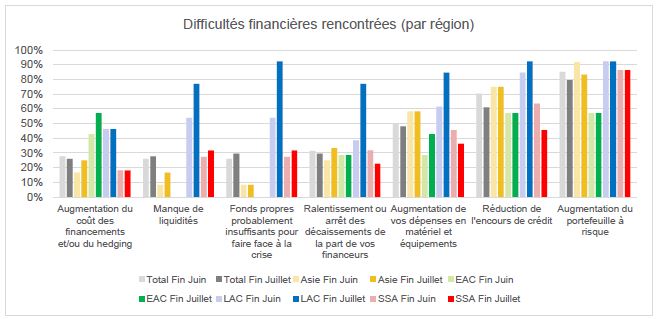

As we have observed since the beginning of our surveys, the increase in the portfolio at risk and the reduction in outstanding credit are the two main direct consequences of the crisis for a microfinance institution. Other financial difficulties, on the other hand, are in lower proportions and are stable from June to July (figure below (5)). This point applies to all regions except Central America, where our partners who responded to all of our surveys report problems and growing fears regarding issues of equity, lack of liquidity or increased expenses.

The detailed analysis shows that the contraction in outstanding credit is a heterogeneous phenomenon. For example, at the level of all respondents, 39% of MFIs in Central Asia reported suffering from a reduction in their portfolio, compared to 55% in Sub-Saharan Africa, 71% in South Asia and 88% in Latin America during the same period.

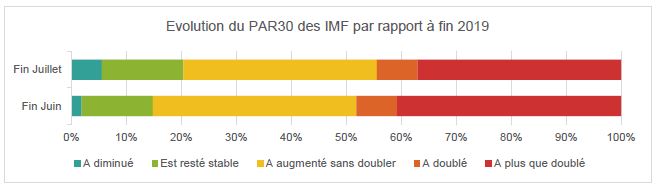

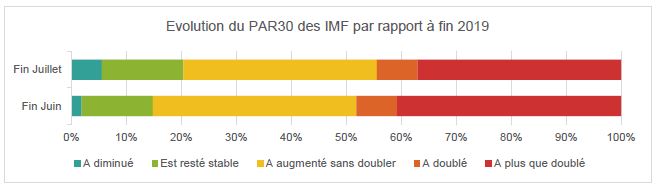

On the other hand, it appears that the increase in portfolio at risk is a problem common to all MFIs, regardless of their region or size, and it concerns more than 80% of our partners. However, while the PAR 30 of microfinance institutions has deteriorated since the beginning of the crisis, it no longer undergoes major changes between June and July, while remaining at a level well above that of before the crisis. As shown in the graph below, the structure of the PAR30 of the partners in the sample of 54 MFIs is fairly stable from one month to the next. And this is a trend we see across all respondents: between 15 and 20% of MFIs see a declining or stable PAR30, while around 40% have seen their PAR30 increase without doubling since the end of 2019. Finally, the riskiest cases regularly represent between 30 and 40% of respondents.

On the other hand, it appears that the increase in portfolio at risk is a problem common to all MFIs, regardless of their region or size, and it concerns more than 80% of our partners. However, while the PAR 30 of microfinance institutions has deteriorated since the beginning of the crisis, it no longer undergoes major changes between June and July, while remaining at a level well above that of before the crisis. As shown in the graph below, the structure of the PAR30 of the partners in the sample of 54 MFIs is fairly stable from one month to the next. And this is a trend we see across all respondents: between 15 and 20% of MFIs see a declining or stable PAR30, while around 40% have seen their PAR30 increase without doubling since the end of 2019. Finally, the riskiest cases regularly represent between 30 and 40% of respondents.

“It is difficult to cover the costs of provisions for bad debts” – Partner in the Democratic Republic of Congo

However, all these difficulties shouldn't be fatal for our partners. When asked about possible strategic changes following the crisis, 93% of respondents do not anticipate any in the short or medium term. Our partners therefore do not feel concerned by potential sales of part of their assets, administrative administration, or liquidations, a sign of a certain confidence in the future.

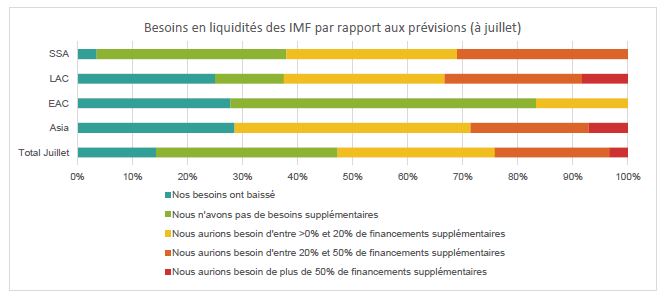

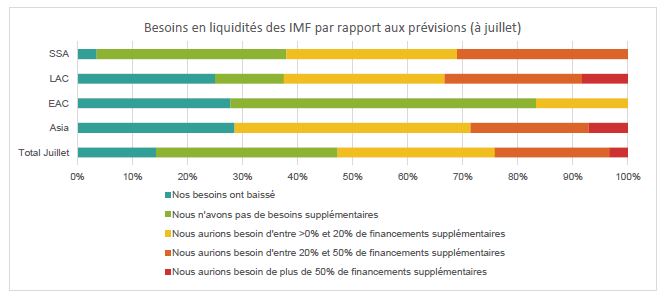

Finally, the latest information from our partners indicates that a liquidity crisis appears to have been avoided, with 24% of respondents highlighting this problem (compared to nearly 40% in our May survey). Moreover, in detail, the proportion of MFIs raising this point in each region does not exceed one-third.

The first explanations lead us first to the multiple deadline extensions granted to MFIs by their foreign and local investors, but also to the reduced levels of disbursements since the beginning of the crisis. It is also worth noting the low proportion of MFIs that have experienced a significant withdrawal of savings since the beginning of the crisis, helping with cash flow management. Among the MFIs that report this difficulty, most come from Sub-Saharan Africa and Asia and do not report significant additional needs compared to other MFIs. These various factors influence the liquidity needs of MFIs. Thus, on a global scale, 47% of the respondents have no additional financing needs for 2020. For nearly a quarter of MFIs outside Sub-Saharan Africa, these have even decreased. Finally, only a quarter of the respondents report significant additional needs.

3. In July, an exposed informal sector

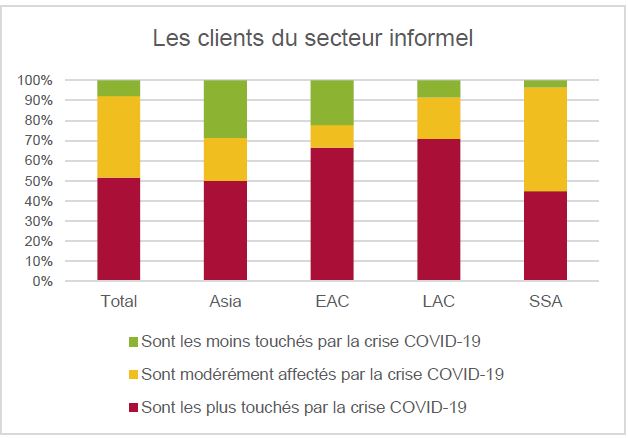

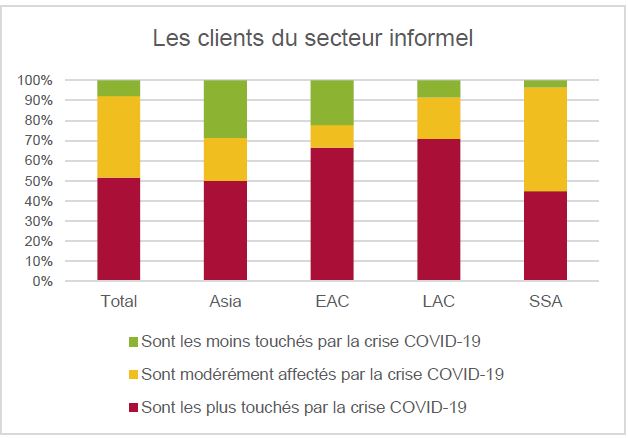

While microfinance institutions are still exposed to the crisis, so are their clients. 92% of our partners indicate that clients operating in the informal economy are either moderately affected by the crisis or the most affected by it. Like all other entrepreneurs and MFI clients, they are suffering from reduced activity, but are also suffering the consequences of major international and national pandemic management measures, for example in the tourism, textile, and cultural sectors. With limited relief resources and reduced activity that cannot generate sufficient income, they would be more vulnerable. This statement is made by a very large majority in Central Asia and Latin America (more than two-thirds of respondents in these regions), while in Sub-Saharan Africa, feedback indicates that clients in the informal economy are impacted in the same way as those in the formal economy.

“Due to current economic and market conditions, it is difficult for small businesses to restart their current economic activities to the level they were at before the COVID-19 crisis” – Partner in Sri Lanka

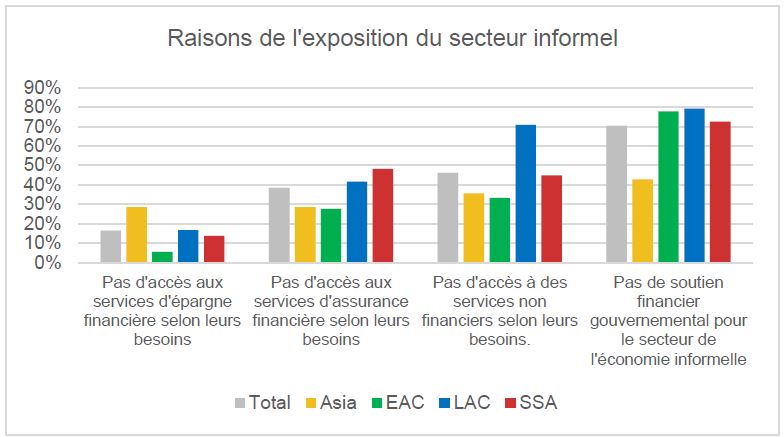

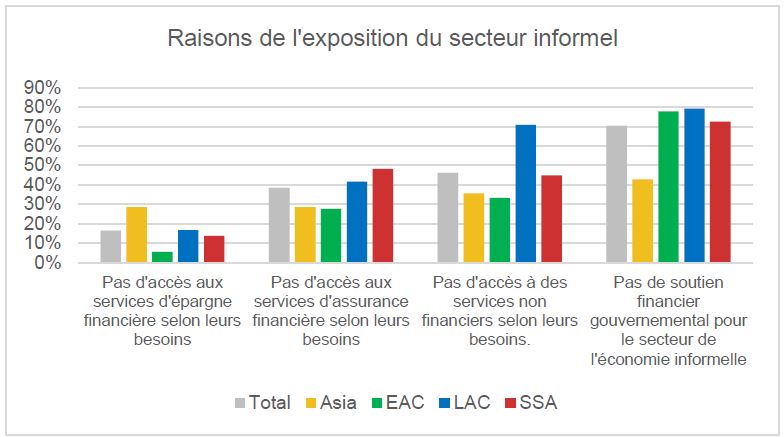

The reasons given by our  partners are primarily financial: the vulnerability of workers in the informal sector is said to stem from the lack of financial support from governments to the sector. This explanation is put forward by a vast majority (78%), who also note at 57% that clients in this sector do not have access to appropriate non-financial services (business development, financial education, health education, etc.). The lack of insurance services is also raised by 50% of these MFIs. On the other hand, the lack of access to savings services is only very rarely mentioned.

partners are primarily financial: the vulnerability of workers in the informal sector is said to stem from the lack of financial support from governments to the sector. This explanation is put forward by a vast majority (78%), who also note at 57% that clients in this sector do not have access to appropriate non-financial services (business development, financial education, health education, etc.). The lack of insurance services is also raised by 50% of these MFIs. On the other hand, the lack of access to savings services is only very rarely mentioned.

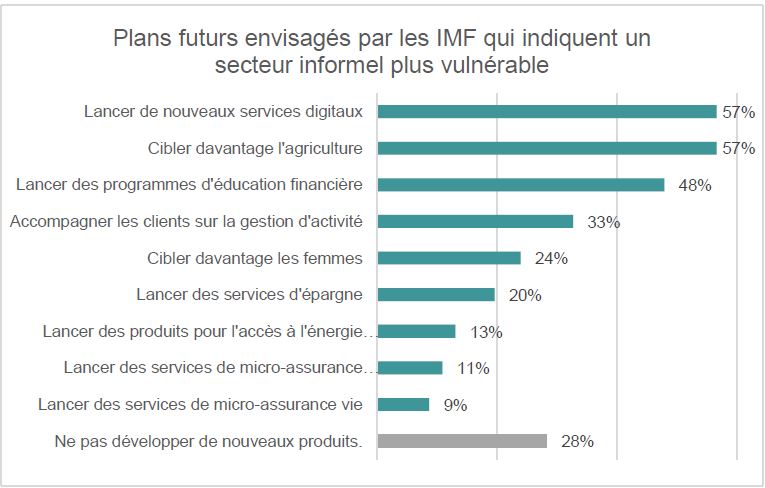

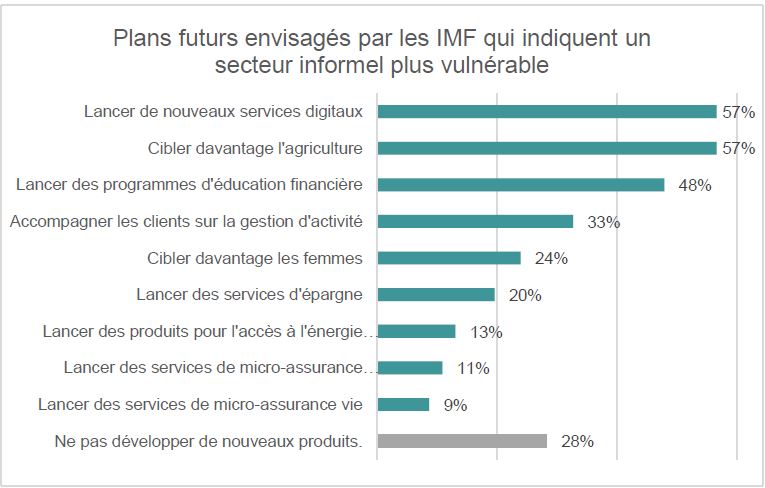

MFIs are already thinking about how best to meet their clients' needs. For example, 48% of the MFIs with a vulnerable informal sector say they plan to launch financial education programs, and 33% envision supporting clients in managing their businesses. However, only a small proportion of them envision launching microinsurance products (maximum 11%). MFIs justify these ambitions for two main reasons: to get closer and focus on underserved populations, to strengthen client relationships, but also to meet a demand for adapted and new offerings during a particular period. For some MFIs, this could translate into other initiatives, such as the development of the agricultural segment (always strongly mentioned by MFIs) or the development of digital solutions for clients, to prepare for the world after. As a partner in Latin America tells us:

"We are planning digital financial education and business management programs to introduce clients to using social media to sell their products, as the main problem they have had is that their retail locations were closed."

"We are planning digital financial education and business management programs to introduce clients to using social media to sell their products, as the main problem they have had is that their retail locations were closed."

The findings of this article highlight the operational and financial challenges faced by MFIs during this first half of the year, as well as their initial steps toward understanding the problems and finding solutions. This context challenges us to continue to explore the most beneficial recovery actions for each region, how they can be implemented, and how the various stakeholders, both directly and indirectly, in the microfinance sector can contribute to its recovery. These questions represent significant challenges, but also important elements for considering the necessary solutions.

____________________________________________________

1 The results of previous surveys are available here for the first and here for the second.

2 The total number of MFIs responding to the survey for each region is as follows: South Asia (“Asia”) 14, Latin America and the Caribbean (“LAC”): 24, Europe and Central Asia (“ECA”): 18, MENA: 6, and Sub-Saharan Africa (“SSA”) 29. For a total of 91 institutions. The small sample size for the MENA region does not allow for tracking of the region’s figures.

3 This comparison is based on a sample of 54 MFIs: 12 in Asia, 7 in EAC, 13 in LAC, 22 in SSA.

4 This comparison again concerns the sample of 54 MFIs.

5 Idem

And while we have been noting for several months the singularity of the Latin American region in the responses collected due to a particularly difficult COVID-19 health context, the information obtained shows that the situation is not resolved in other regions.

And while we have been noting for several months the singularity of the Latin American region in the responses collected due to a particularly difficult COVID-19 health context, the information obtained shows that the situation is not resolved in other regions.

On the other hand, it appears that the increase in portfolio at risk is a problem common to all MFIs, regardless of their region or size, and it concerns more than 80% of our partners. However, while the PAR 30 of microfinance institutions has deteriorated since the beginning of the crisis, it no longer undergoes major changes between June and July, while remaining at a level well above that of before the crisis. As shown in the graph below, the structure of the PAR30 of the partners in the sample of 54 MFIs is fairly stable from one month to the next. And this is a trend we see across all respondents: between 15 and 20% of MFIs see a declining or stable PAR30, while around 40% have seen their PAR30 increase without doubling since the end of 2019. Finally, the riskiest cases regularly represent between 30 and 40% of respondents.

On the other hand, it appears that the increase in portfolio at risk is a problem common to all MFIs, regardless of their region or size, and it concerns more than 80% of our partners. However, while the PAR 30 of microfinance institutions has deteriorated since the beginning of the crisis, it no longer undergoes major changes between June and July, while remaining at a level well above that of before the crisis. As shown in the graph below, the structure of the PAR30 of the partners in the sample of 54 MFIs is fairly stable from one month to the next. And this is a trend we see across all respondents: between 15 and 20% of MFIs see a declining or stable PAR30, while around 40% have seen their PAR30 increase without doubling since the end of 2019. Finally, the riskiest cases regularly represent between 30 and 40% of respondents.

partners are primarily financial: the vulnerability of workers in the informal sector is said to stem from the lack of financial support from governments to the sector. This explanation is put forward by a vast majority (78%), who also note at 57% that clients in this sector do not have access to appropriate non-financial services (business development, financial education, health education, etc.). The lack of insurance services is also raised by 50% of these MFIs. On the other hand, the lack of access to savings services is only very rarely mentioned.

partners are primarily financial: the vulnerability of workers in the informal sector is said to stem from the lack of financial support from governments to the sector. This explanation is put forward by a vast majority (78%), who also note at 57% that clients in this sector do not have access to appropriate non-financial services (business development, financial education, health education, etc.). The lack of insurance services is also raised by 50% of these MFIs. On the other hand, the lack of access to savings services is only very rarely mentioned. "We are planning digital financial education and business management programs to introduce clients to using social media to sell their products, as the main problem they have had is that their retail locations were closed."

"We are planning digital financial education and business management programs to introduce clients to using social media to sell their products, as the main problem they have had is that their retail locations were closed."

Launched by the Grameen Crédit Agricole Foundation and Crédit Agricole SA, Solidarity Bankers is a skills-based volunteer program open to Group employees that supports microfinance institutions and impactful businesses. The program has a twofold objective: to enhance the skills of Crédit Agricole Group employees and to provide additional support to the Foundation's partner microfinance institutions and impactful businesses. Through this program, the Crédit Agricole Group reaffirms its commitment to supporting employee solidarity initiatives.

Launched by the Grameen Crédit Agricole Foundation and Crédit Agricole SA, Solidarity Bankers is a skills-based volunteer program open to Group employees that supports microfinance institutions and impactful businesses. The program has a twofold objective: to enhance the skills of Crédit Agricole Group employees and to provide additional support to the Foundation's partner microfinance institutions and impactful businesses. Through this program, the Crédit Agricole Group reaffirms its commitment to supporting employee solidarity initiatives.