Increased support from VisionFund International

VISION FUND SENEGAL ©Philippe Lissac/GODONG for the Grameen Credit Agricole Foundation

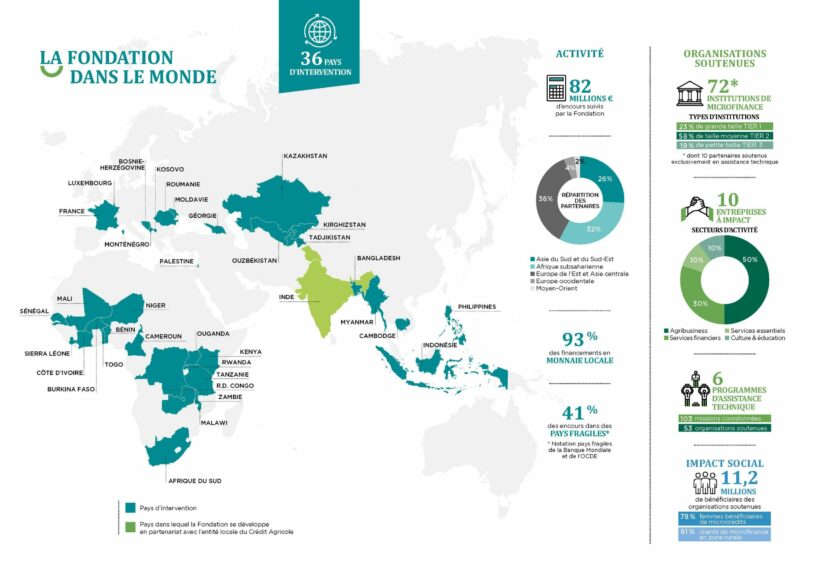

The Grameen Crédit Agricole Foundation recently granted a loan of 3 million euros to the holding company VisionFund International, the central body of the VisionFund network specializing in microfinance. This support is part of a long-standing collaboration, with the Foundation already supporting VisionFund for 10 years.

With a total exposure of approximately €10 million spread across eight entities, VisionFund thus becomes the Foundation's first global partner. This cooperation aims to develop financial products tailored to women entrepreneurs, particularly in the agricultural sector, and especially those facing the challenges of climate change.

The objectives of this partnership also include measuring the impact and effectiveness of poverty reduction initiatives. In addition, the Foundation will continue to support VisionFund's efforts in sub-Saharan Africa and will support the opening of a new entity in Ukraine.

This initiative marks an important step in the Grameen Crédit Agricole Foundation's commitment to economic and social development throughout the world.