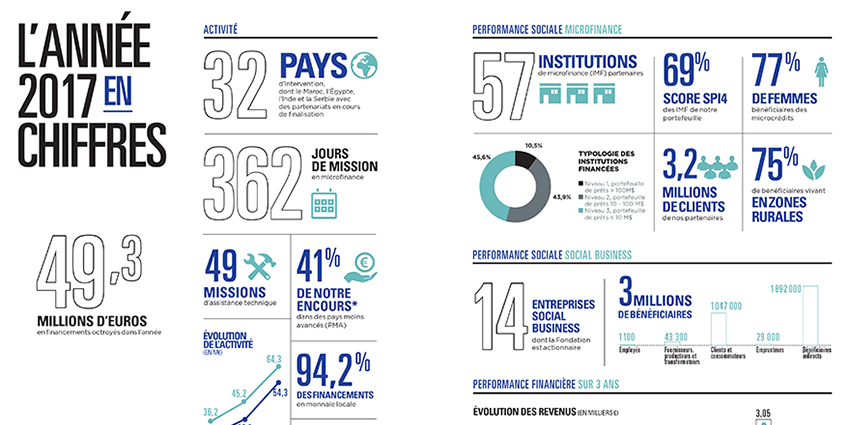

A new partnership between the Foundation and Crédit Agricole Egypt

By Violette Cubier, Grameen Crédit Agricole Foundation

The Grameen Crédit Agricole Foundation and Crédit Agricole Egypt have signed a partnership agreement to structure a loan facility for DBACD, one of the largest MFIs in Egypt. Read the interview with Walie Lotfy, Head of Retail Banking at Crédit Agricole Egypt.

Interview with Walie Lotfy, Head of Retail Banking at Crédit Agricole Egypt

Could you introduce the partnership between Crédit Agricole Egypt and the Grameen Crédit Agricole Foundation?

The project of a partnership between Crédit Agricole Egypt (CA Egypt) and the Grameen Crédit Agricole Foundation (GCA Foundation) was born more than three years ago. However, regulatory constraints prevented us, at the time, from realizing our cooperation. Because CA Egypt, like the GCA Foundation, was convinced of the importance of this partnership and the market potential, we relaunched our project in 2017 around a completely renewed and better structured cooperation scheme, which meets the Group's requirements and regulatory requirements, particularly with regard to compliance issues.

We have partnered to structure a loan facility for microfinance institutions (MFIs). The first transaction, worth EGP 58 million (approximately EUR 2.8 million), was successfully completed for the benefit of a leading MFI in Egypt, the Dakahlya Businessmen Association for Community Development (DBACD).

With this first successful transaction, CA Egypt joins the ranks of banks contributing to the development of microfinance in the country. CA Egypt is thus expanding its range of services by reaching new sectors, in line with the Bank's sustainable growth strategy.

How can the banking sector contribute to the development of microfinance in Egypt?

Historically, the banking sector in Egypt has avoided entering the microfinance sector due to its complexity. As a result, public banks have long dominated this market. However, the Central Bank of Egypt has recently implemented mechanisms to incentivize banks to support the development of microfinance in the country. Moreover, all banks have recognized the vast potential of the microfinance market, not only due to the quality of assets but also the high levels of profitability. Most banks are now competing to lend to microfinance institutions.

In your opinion, what is the added value of the Grameen Crédit Agricole Foundation and what are the prospects for the partnership?

This partnership aligns with the Group's strategy to strengthen synergies between its various entities. It brings mutual benefits to both the GCA Foundation and CA Egypt. For the GCA Foundation, this partnership opens new markets for its expansion. For CA Egypt, being able to rely on the Foundation's knowledge and expertise is a significant support in diversifying its range of services and entering the microfinance market in Egypt while limiting the associated risks. This partnership will allow CA Egypt to gain an edge over competitors lacking this type of expertise.

The partnership also allows the Bank to gain visibility and acquire a better positioning in the microfinance sector, thanks to the reputation of the GCA Foundation which is recognized as one of the benchmark players in the sector.

I believe this collaboration has strong potential. We have learned several lessons from this pilot transaction, and we will continue to optimize the system to develop a more competitive offering and thus increase our impact, while keeping risks under control.