A look back in pictures: celebrating the Foundation’s 15th anniversary

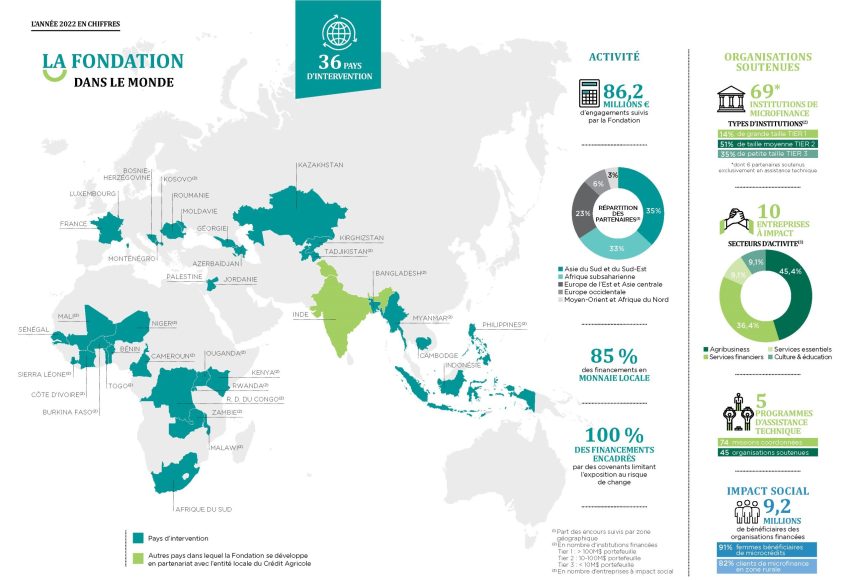

On November 28, 2023, Crédit Agricole SA and the Grameen Crédit Agricole Foundation celebrated the fifteenth anniversary of the Foundation by organizing a Night of Inclusion at the Philanthro-Lab in Paris, and brought together 150 guests. After 15 years of action, the Foundation and its co-founders reaffirmed their commitment to inclusive and sustainable finance, alongside the Foundation's directors and partners. Foundation President Raphaël Appert opened the evening by recalling the Foundation's origins and taking stock of these 15 years.

The evening was introduced by Raphaël Appert, President, and Véronique Faujour, General Delegate of the Grameen Crédit Agricole Foundation.

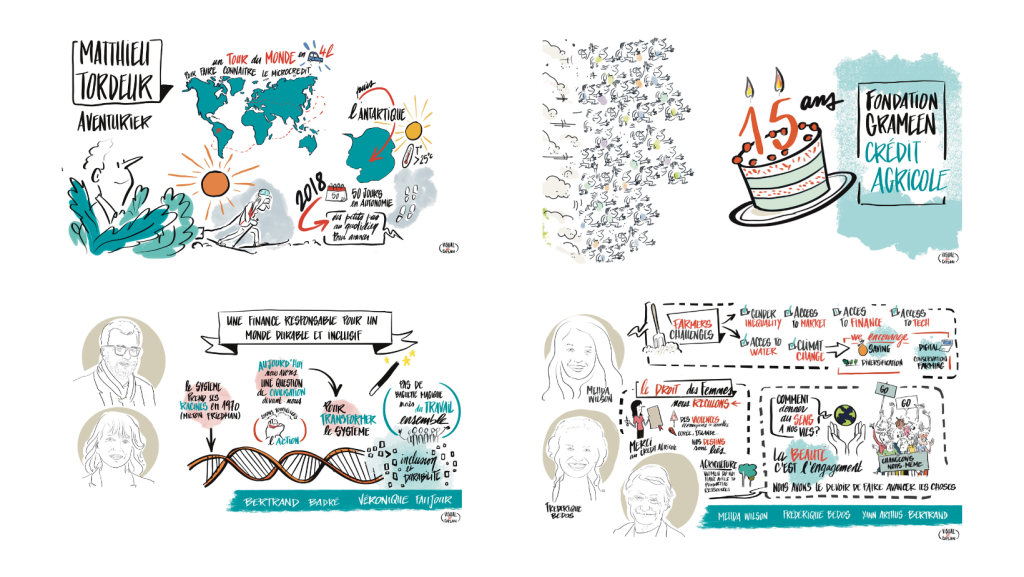

Véronique Faujour, the Foundation's Executive Director, then unveiled the Foundation's ambitions and its roadmap for at least the next 15 years. The evening then focused on the theme of inclusion, with various speakers:

Professor Muhammad Yunus, founder of Grameen Bank and member of the Board of Directors ofThe Grameen Crédit Agricole Foundation and Bertrand Badré, Managing Partner and founder of Blue like an Orange Sustainable Capital and Yann Arthus Bertrand spoke to provide the context for inclusion.

Medha Wilson, Managing Director of the MicroLoan UK Foundation, a partner of the Foundation, and Frédérique Bedos, journalist and filmmaker, spoke respectively to explain how financial inclusion and support for small farmers in Zambia, Zimbabwe, and Malawi is being implemented on the ground and how to improve the inclusion of women entrepreneurs.

Matthew Tordeur, adventurer and speaker, member of the Society of French Explorers, concluded the conference.

A graphic facilitator summarized the various interventions live in drawings.

And finally, clown analysts livened up the evening!

Discover the film that was shown at the opening of the conference and which takes stock of the 15 years of the Grameen Crédit Agricole Foundation.