©Ed-Dunens / Adobestock

ADA, Inpulse and the Grameen Crédit Agricole Foundation partnered in 2020 to monitor and analyze the effects of the Covid-19 crisis on their partner microfinance institutions around the world. This monitoring was carried out periodically throughout 2020 to gain a better understanding of the evolution of the crisis internationally. We are extending this work this year, on a quarterly basis. The findings presented in this article follow the second quarter of 2021. With this regular analysis, we hope to contribute, at our level, to the development of strategies and solutions adapted to the needs of our partners, as well as to the dissemination and exchange of information between the various players in the sector.

In summary

The results presented in the following pages come from the seventh survey in the joint series[1] to ADA, Inpulse and the Grameen Crédit Agricole Foundation. Responses from our partner microfinance institutions (MFIs) were collected during the second half of July 2021. The 78 responding institutions are located in 40 countries in Sub-Saharan Africa (SSA-32%), Latin America and the Caribbean (LAC-30%), Eastern Europe and Central Asia (EAC-22%), the Middle East and North Africa (MENA-9%) and South and Southeast Asia (SSEA-6%).[2].

The generally positive trend nevertheless hides very contrasting realities between institutions which are growing again (the majority), and others which continue to encounter difficult economic conditions. The first group shows growth in their outstanding amounts and positive trend development projections for the end of 2021. These prospects nevertheless remain measured (mainly between 0 and 10% of portfolio growth) since certain factors such as customer demand or risk management still have an impact on expansion possibilities.

On the other hand, some institutions are facing difficulties specific to health contexts, the effects of which are weighing on economic life and having a very significant impact on transaction volumes. As a result, the profitability of their financial performance is affected to the point of materializing negatively, for the most fragile, on their equity.

- An operational context which continues to improve overall

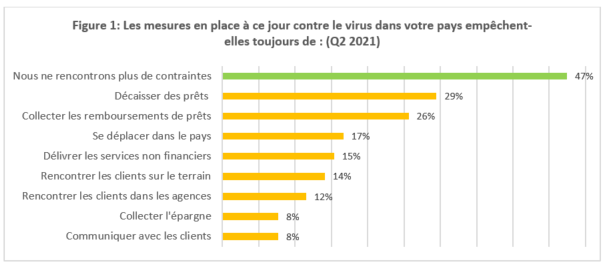

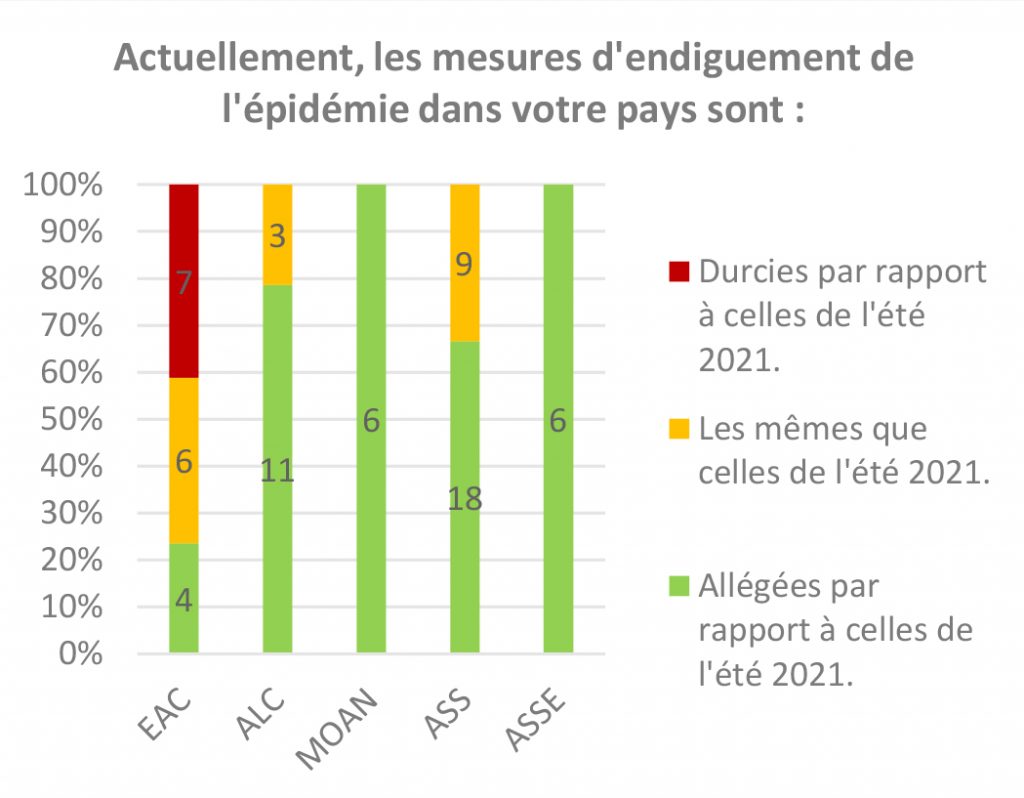

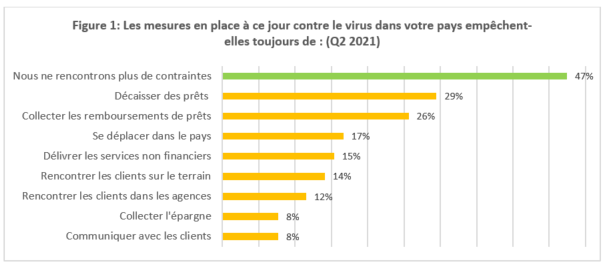

The reduction in operational constraints and the gradual resumption of activities are confirmed once again in this latest survey. Of course, this trend hides some less positive disparities due to the measures taken to combat the spread of the virus. At the beginning of July 2021, 47% of the institutions surveyed reported no longer encountering operational constraints on a daily basis (Figure 1). Also, all the constraints related to traveling within the country and meeting customers do not concern more than 20% of the respondents.

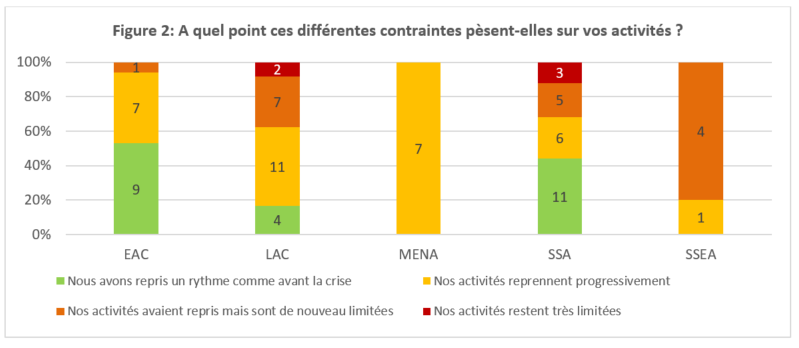

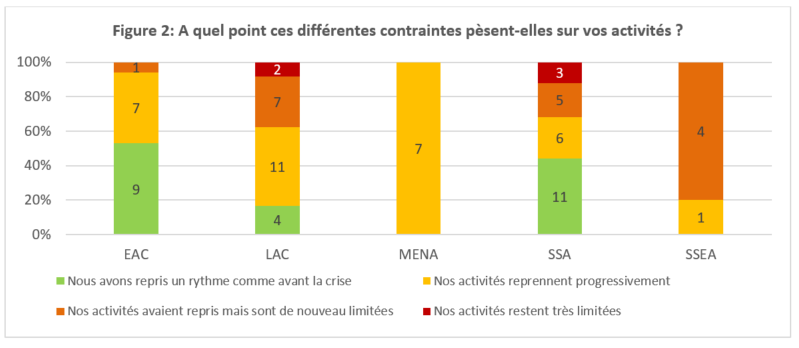

This is in fact reflected in the level of activity of the institutions: 72% of MFIs have either resumed a pace similar to that of before the crisis or are experiencing a gradual recovery without major interruption (Figure 2). This phenomenon is particularly visible in the ECA region where the level of activity has not decreased for almost all institutions. In the LAC and SSA regions, a majority of organizations are in the same situation (respectively 63% and 68%). In these regions, the difficulties are particularly felt in East Africa, Panama and Honduras. Finally, For MFIs in the MENA region, the trend is towards recovery, while those located in SSEA are largely facing new difficulties (Cambodia, Laos, Myanmar, Sri Lanka).

- Some microfinance institutions have returned to growth

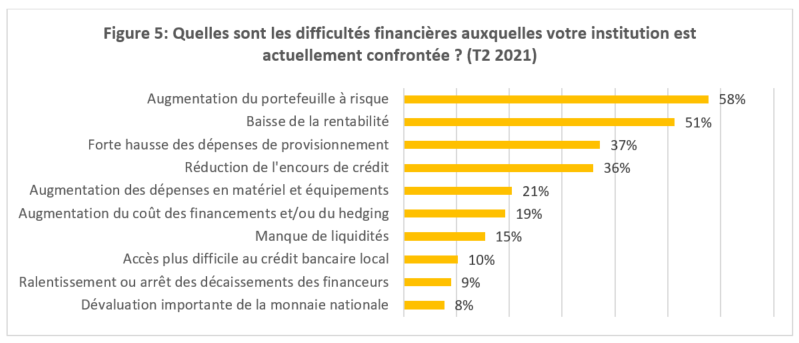

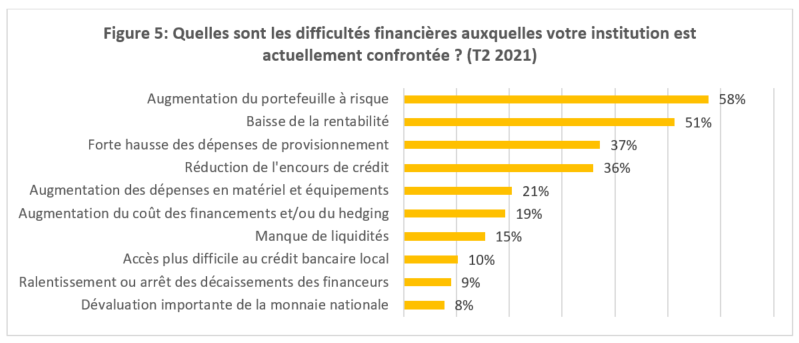

It is in this context that MFIs continue to disburse loans to their clients. While the increase in the portfolio at risk (PAR) and the reduction in the loan portfolio were the major financial consequences of the crisis in 2020, only 36% of the MFIs surveyed in July still report seeing a decline in their outstanding loans (figure 5).

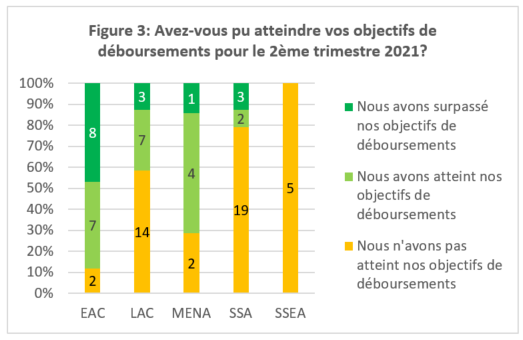

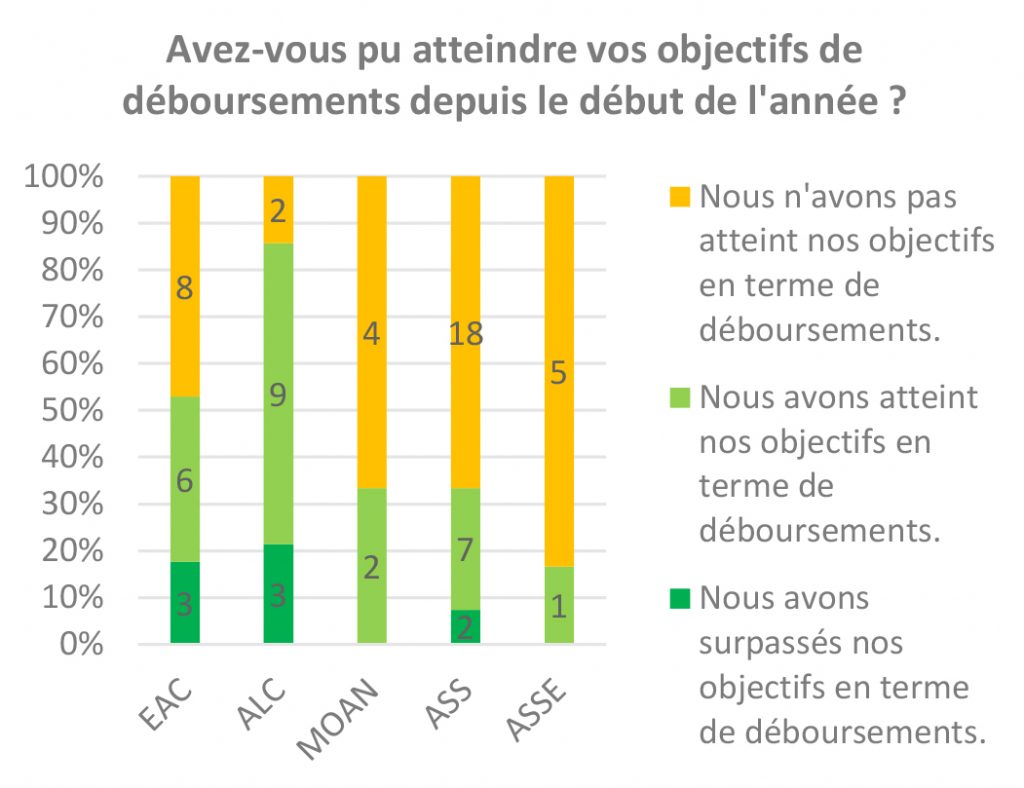

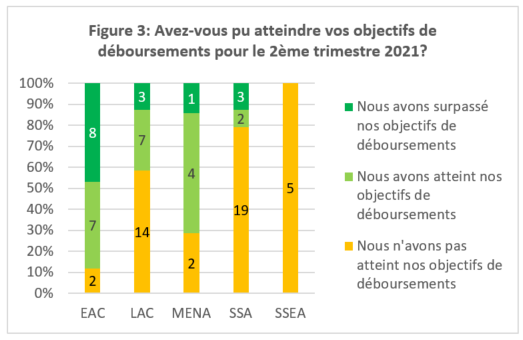

This positive analysis nevertheless hides a slow process, as shown by the responses of our partners regarding the achievement or not of their disbursement targets in Q2 2021. More than half (53%) indicate that they did not reach their disbursement targets during this period, a figure relatively close to that obtained in the first quarter. This result is not entirely correlated with the level of operations of an organization: more than half of the MFIs in the LAC and SSA regions report unfulfilled objectives despite a favorable operational environment. Note that Three major reasons are cited by MFIs that did not achieve their growth targets during this quarter : the decrease in the amounts requested by clients (45% of them), the reluctance of clients to commit to new loans (43%) and risk management by focusing only on existing clients (38%). Thus, MFIs in the EAC region are exceptional with excellent performances in Q2 2021.

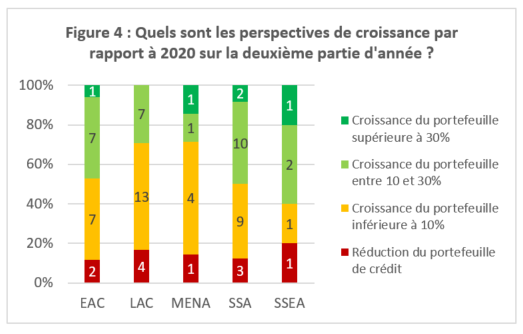

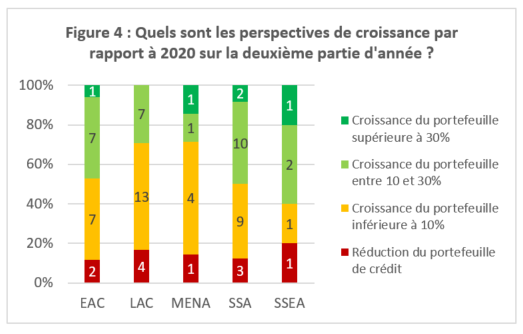

Although these indicators show an inconsistent pace of development, 2021 should nevertheless end with growth in outstanding loans for the vast majority of MFIs. Indeed, 86% of the institutions surveyed expect to have outstanding amounts higher than those of December 2020 at the end of 2021. This growth will also be reasonable for a large proportion of them: 44% of respondents forecast portfolio growth of between 0 and 10%, particularly in the MENA and LAC regions. For just over a third of MFIs (36%), it will be between 10 and 30%. Projections are split between these two estimates in the other three regions analyzed. Finally, note that a proportion of 10 to 20% of MFIs in each zone anticipate a reduction in their outstanding amount.

- Although still present, credit risk remains under control

Despite these reassuring indications regarding portfolio growth, MFIs still have to manage high credit risk, a lingering remnant of the crisis. 58% of respondents in Q2 2021 report that their current risk portfolio remains higher than at the start of 2020. While some institutions still have an active moratorium (only 5%), loans from customers in difficulty at the start of the crisis now appear in the PAR, as restructured loans or late payments. In addition, there are late payment customers who did not have a moratorium. All of these loans are subject to a provision to cover the proven risk of default. Therefore, we find the decline in profitability as another major financial consequence of the crisis, fueled by the sharp increase in provisioning expenses and the reduction in outstanding amounts.

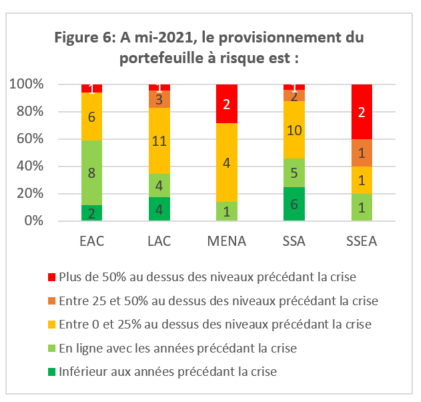

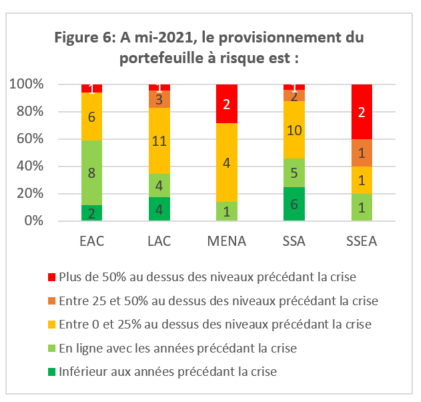

In detail, It appears that 59% of our partners have increased their level of provisions compared to before the crisis (Figure 6). For the majority of them (71% of these 59%), the increase is between 0 and 25% of the usual amount, a situation found in each zone except the SSEA region. Conversely, there is a group of MFIs (40%) no longer seeing a major increase in credit risk and whose provisioning expenses are similar to the past, or even decreasing. In this regard, the ECA zone stands out again since this is the case for nearly 60% of the organizations surveyed in the region.

However, as we noted in our recent studies, this has not yet materialized into a very sharp increase in loan write-offs. HAS At the end of the second quarter of 2021, 59% of respondents indicated that the levels of loans written off for the year were either down compared to previous years or at the same level.. Nevertheless, 13% of MFIs had to write off at least double what they had before the crisis.

- Equity capital has been largely saved so far

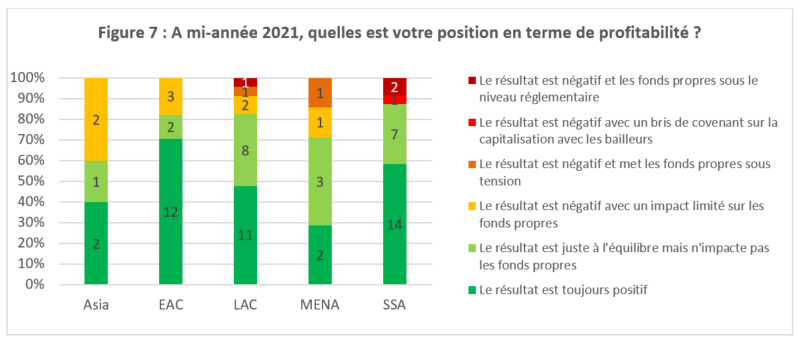

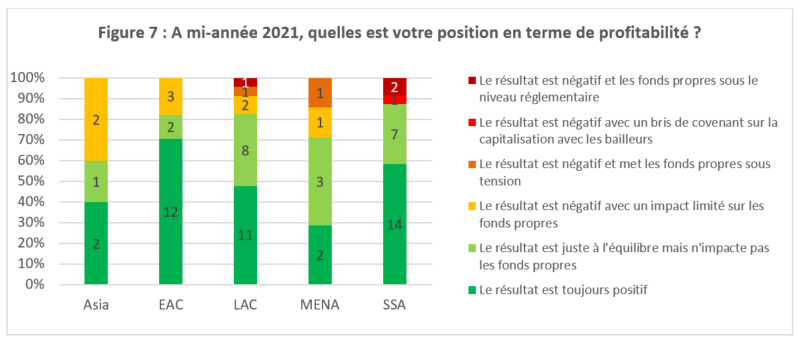

The profitability of microfinance institutions is affected by the return of activities, the variation in outstanding credit and risk coverage. (factors presented in the paragraphs above). For 51% of our partners, the trend is downward (Figure 5). However, the information collected at the end of June 2021 is reassuring: 80% of those surveyed have a profitability level at least at breakeven, which therefore has no consequences on the capital of their structure (Figure 7). In the same sense, Despite the negative result, 11% of those surveyed do not feel any pressure on their equity. The situation is nevertheless more critical for 8% of the partners interviewed., whose capitalization level is in danger, leading to a potential breach of covenant with their lessors or the regulator.

Faced with the difficulties of certain clients, who are facing new waves of complications related to the Covid-19 pandemic or other factors, potential losses could affect the solvency of microfinance institutions. Some already require the intervention of their shareholders or investors. We learned in our latest study that the type of shareholders institutions wish to target depends on the reason for which this support is necessary (cover losses or, indeed, to grow). This survey shows that the question is already being asked for 20% of respondents: needs may arise despite recent capital support, but some MFIs are also without solutions to this issue (10%). These cases show that the impact of the crisis will still be felt on institutions already severely affected by this unprecedented period, but also on less robust MFIs. Vigilance regarding capital needs remains essential since the long-term impact of credit risk could tip the scales for other organizations if the general situation does not improve, for example with the arrival of new epidemic waves.

Faced with the difficulties of certain clients, who are facing new waves of complications related to the Covid-19 pandemic or other factors, potential losses could affect the solvency of microfinance institutions. Some already require the intervention of their shareholders or investors. We learned in our latest study that the type of shareholders institutions wish to target depends on the reason for which this support is necessary (cover losses or, indeed, to grow). This survey shows that the question is already being asked for 20% of respondents: needs may arise despite recent capital support, but some MFIs are also without solutions to this issue (10%). These cases show that the impact of the crisis will still be felt on institutions already severely affected by this unprecedented period, but also on less robust MFIs. Vigilance regarding capital needs remains essential since the long-term impact of credit risk could tip the scales for other organizations if the general situation does not improve, for example with the arrival of new epidemic waves.

[1] The results of the first five surveys are available here: //www.gca-foundation.org/observatoire-covid-19/, //www.ada-microfinance.org/fr/crise-du-covid-19/ And //www.inpulse.coop/news-and-media/

[2] Number of responding MFIs by region: EAC 17 MFIs; SSA 25 MFIs; LAC 24 MFIs; SSEA 5 MFIs; MENA: 7 MFIs.

Eastern European MFIs (Bulgaria, Lithuania, Moldova, and Romania) stand out as an exception to this dynamic, as some of them (7 out of 13 MFIs in this sub-region) are experiencing a more difficult context during this period, linked to the resurgence of the epidemic in the region in the last quarter. This is reflected in particular by difficulties in meeting clients in the field or in branches and therefore in carrying out activities in general (collection and disbursement of loans).

Eastern European MFIs (Bulgaria, Lithuania, Moldova, and Romania) stand out as an exception to this dynamic, as some of them (7 out of 13 MFIs in this sub-region) are experiencing a more difficult context during this period, linked to the resurgence of the epidemic in the region in the last quarter. This is reflected in particular by difficulties in meeting clients in the field or in branches and therefore in carrying out activities in general (collection and disbursement of loans). The low disbursement levels are primarily linked to the difficulties experienced by MFI clients. Among the MFIs that are not achieving the expected growth levels this year, the two most cited reasons (54% and 49% respectively) are the deteriorated risk profile of the clientele and the reluctance of clients to take out new loans. This justification is also confirmed by the fact that 53% of the respondents still have a higher-risk portfolio than before the crisis. This persistent increase in risk and the situation of a portion of MFI clients whose needs are low or even nonexistent, therefore limits the development possibilities of MFIs.

The low disbursement levels are primarily linked to the difficulties experienced by MFI clients. Among the MFIs that are not achieving the expected growth levels this year, the two most cited reasons (54% and 49% respectively) are the deteriorated risk profile of the clientele and the reluctance of clients to take out new loans. This justification is also confirmed by the fact that 53% of the respondents still have a higher-risk portfolio than before the crisis. This persistent increase in risk and the situation of a portion of MFI clients whose needs are low or even nonexistent, therefore limits the development possibilities of MFIs.

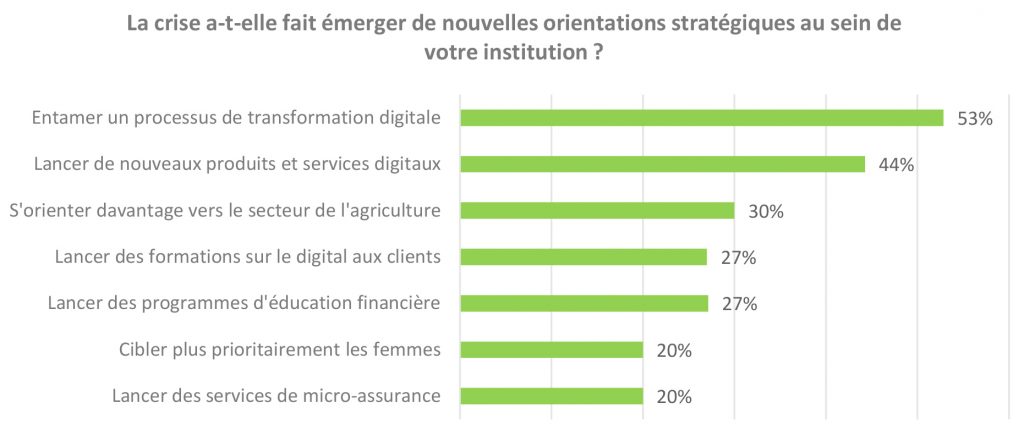

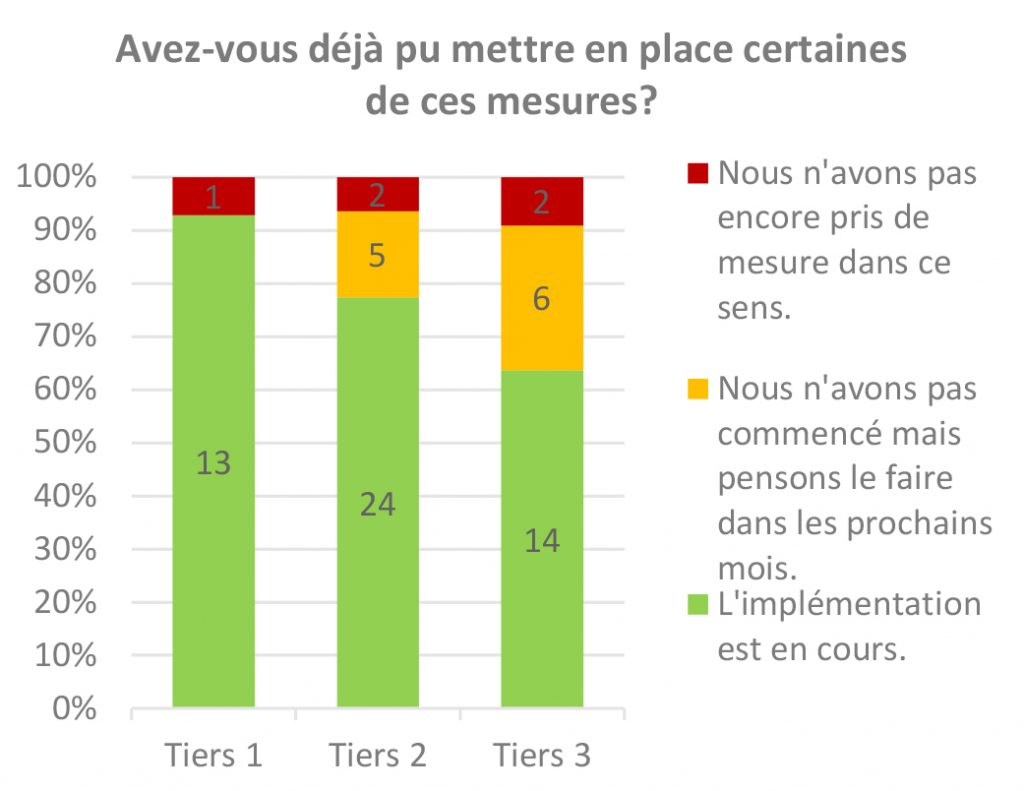

We note that 76% of the MFIs have already started implementing measures related to these strategic axes and 16% plan to launch actions in this direction in the coming months. Thus, only 7% of the sample presents less obvious prospects on this point. A certain gap in the implementation of these measures emerges, however, depending on the size of the institutions: the vast majority of Tier 1 MFIs (93%) have already implemented such measures while this proportion drops to 77% for Tier 2 and 64% for Tier 3 MFIs.

We note that 76% of the MFIs have already started implementing measures related to these strategic axes and 16% plan to launch actions in this direction in the coming months. Thus, only 7% of the sample presents less obvious prospects on this point. A certain gap in the implementation of these measures emerges, however, depending on the size of the institutions: the vast majority of Tier 1 MFIs (93%) have already implemented such measures while this proportion drops to 77% for Tier 2 and 64% for Tier 3 MFIs.

Faced with the difficulties of certain clients, who are facing new waves of complications related to the Covid-19 pandemic or other factors, potential losses could affect the solvency of microfinance institutions. Some already require the intervention of their shareholders or investors. We learned in our

Faced with the difficulties of certain clients, who are facing new waves of complications related to the Covid-19 pandemic or other factors, potential losses could affect the solvency of microfinance institutions. Some already require the intervention of their shareholders or investors. We learned in our