Survey on Financial Inclusion of People with Disabilities in Cambodia

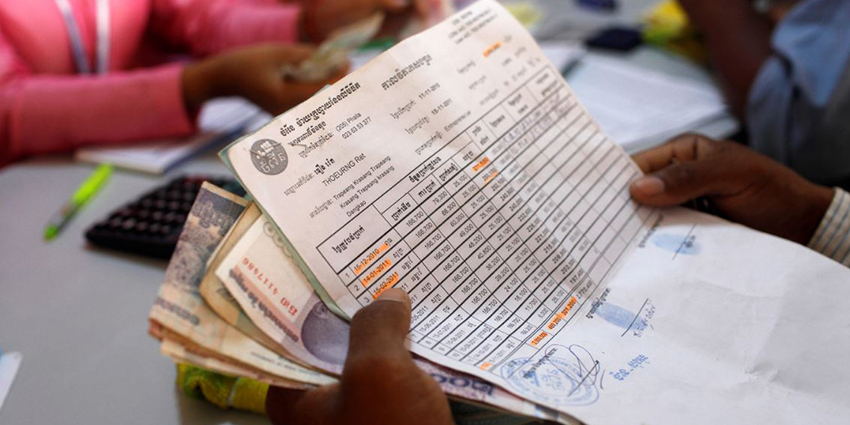

In Cambodia, at least 101,000 people with disabilities suffer from some form of disability and often experience social and economic exclusion and stigma. Strengthening their ability to access financial services can help break the cycle between disability and poverty. In this context, a study was conducted by Chamroeun Microfinance Plc and Good Return to better understand the needs and barriers faced by people with disabilities in accessing financial services.

The study's findings demonstrate the link between disability and exclusion and the untapped opportunities to break this cycle. While only 30% of the 513 respondents have used financial services, more than 50% are considering a loan in the future, primarily for entrepreneurial activities, and 90% see the benefits of financial education training.

This study will contribute to structuring the “Education and Access: Responsible Service for People with Disabilities” project of the Australia-Cambodia Cooperation Program for Equitable Sustainable Services (ACCESS) which aims to improve access to responsible finance for people with disabilities.

Supported by the Grameen Crédit Agricole Foundation since 2010, Chamroeun Microfinance Plc is a Cambodian microfinance institution that provides financial services to the poorest populations, as well as training and support services. It currently serves nearly 43,000 clients, of whom 81% are women and 65% live in rural areas.

Access the study (in English) here

Leave a Reply

Want to join the discussion?Feel free to contribute!