The Grameen Crédit Agricole Foundation publishes its first Impact Report

To better understand and share the results of its work, the Grameen Crédit Agricole Foundation is publishing its first Impact Report, a financial and non-financial assessment based on 2019 activity data. The impact assessment was conducted with CERISE, an independent firm specializing in impact measurement and social performance. This report aims to provide an objective and concise overview of the Foundation's contribution and its methods of action in favor of impact entrepreneurship and access to essential services.

Humanity is facing a period unlike any other in history. The crisis generated by Covid-19 has disrupted our societies, our economies, and our activities. In a world where inequalities are widening and low-income populations are disproportionately affected, financial inclusion and entrepreneurship are factors for improving the resilience of these vulnerable populations. These are the levers of action of the Grameen Crédit Agricole Foundation, which for nearly 12 years has contributed to reducing inequalities and poverty through financial inclusion and impact entrepreneurship.

Today, the Foundation is publishing its first Impact Report, produced with the methodological assistance of CERISE, a pioneering organization specializing in the promotion of responsible finance. It aims to provide an objective and concise overview of the Foundation's contribution and its methods of action. Defining its impact model, objectives, beneficiaries, and levers of action constitutes the first step in more actively managing the Foundation's impact and social utility.

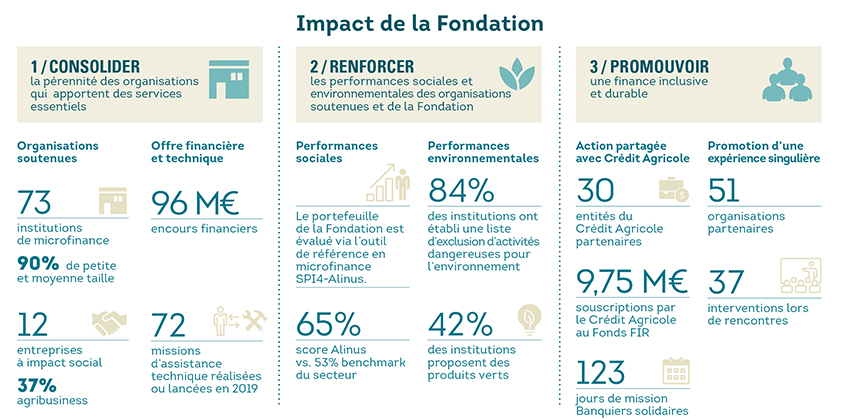

Direct impact of the Foundation

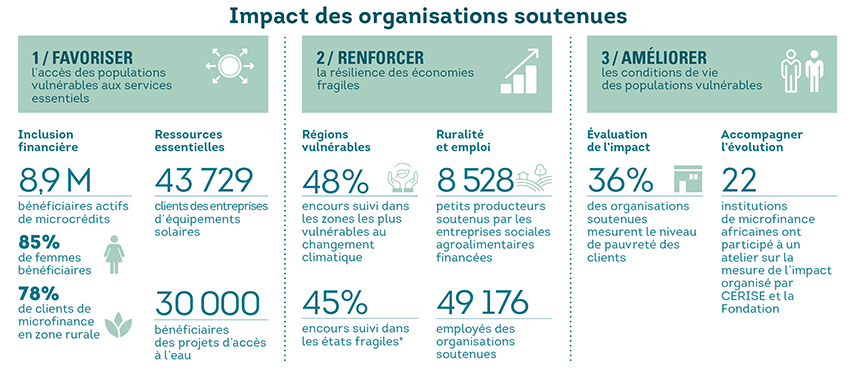

The Foundation aims to create sustainable value by reconciling social, economic, and environmental impacts. Its value creation model is based on long-term support for socially successful microfinance institutions and social impact businesses that promote access to essential services. The Foundation promotes women's empowerment by promoting female entrepreneurship (85% women receiving microcredit through the organizations supported), primarily in rural areas (78% of microcredit borrowers live there). Sub-Saharan Africa (37% of its outstanding loans) and South and Southeast Asia (29%) are its two geographic areas of reference.

The impact of the supported organizations

The Foundation also provides technical assistance to funded organizations to strengthen their social and environmental performance. On the social side, the Foundation's portfolio is evaluated using ALINUS, a microfinance social performance management tool. In all areas evaluated, the supported microfinance institutions have performed better than the industry benchmark (with a score of 65% vs. 53% in the industry). In terms of environmental performance, monitoring is more recent but is progressing. For example, 84% of the supported institutions have established an exclusion list of environmentally hazardous activities, and 42% offer green products that finance ecological practices.

Finally, the Foundation leverages its impact through its partnerships with Crédit Agricole and other major development aid organizations. In 2019, the Foundation worked with 51 private, public, and solidarity-based organizations in some 40 countries.

In 2020, the Foundation will continue its impact measurement work with the operational deployment of tools and a field study to verify the robustness of its impact model. It will continue to write the chapters of its history in a more collective, more engaged, and more sustainable manner.

Leave a Reply

Want to join the discussion?Feel free to contribute!