The international context encourages vigilance towards MFIs and their clients

Since 2020, Inpulse and the Grameen Crédit Agricole Foundation have been working to analyze and monitor the effects of the COVID-19 pandemic crisis on the microfinance institutions (MFIs) they fund. This periodic monitoring, shared through several articles[1], contributes to the exchange of information between the different players in the sector.

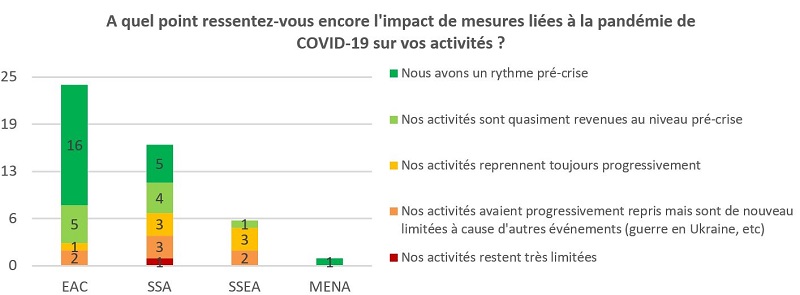

The findings presented in this article follow the latest study conducted in early May 2022. Given the international context marked in particular by the war in Ukraine, the content of the survey was adapted to better understand the impacts of this conflict on the microfinance sector. The 47 institutions that responded are located in Europe and Central Asia (EAC-51%), Sub-Saharan Africa (SSA-34%), South and Southeast Asia (SSEA-13%) and the Middle East and North Africa (MENA-2%).[2].

- The latent risk linked to COVID-19 is gradually reducing

As we have seen uninterruptedly for a year with the global economic recovery, the major consequences linked to the lockdown phases since the start of the COVID-19 pandemic have gradually faded for MFIs. Thus, at the end of May 2022, almost all respondents still report a continuous resumption of activities and 68% (32 MFIs) even indicate that they have returned or almost returned to a rate known before the health crisis.

The main financial consequence linked to COVID-19 still perceptible for 30% of respondents is the persistence of a high-risk portfolio compared to the end of 2019. This point, however, remains less and less significant as operations have been able to resume in a more or less stable manner and the moratoriums granted are gradually being repaid.

This effect is thus visible at the level of the entire MFI portfolio of the Grameen Crédit Agricole Foundation, where the credit risk (PAR30, restructured loans and COVID-19 moratoria) is improving: it was 10% at the end of March 2022 compared to 21% at December 2020 (the average in 2019 was 5%). This improvement is also observed in the portfolio of MFIs financed by Inpulse, whether clients in MENA or in Central and Eastern Europe. In the case of clients in the MENA region, the deterioration of their portfolio was very significant in 2020, reaching up to 37% of their outstanding credit, but it improved significantly in 2022, to 14%, with a value closer to the pre-crisis risk level (10.2%). For clients in Central and Eastern Europe, this credit risk was 3.3% for the first quarter of this year, compared to 8.6% in 2020, almost the same level as in 2019 (2.7%).

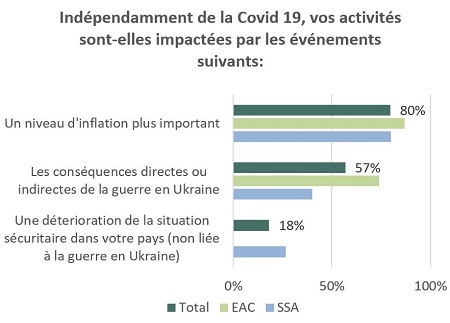

- Other events affecting microfinance institutions: inflation before the consequences of the war in Ukraine

This survey clearly shows that, from now on, factors other than the COVID-19 crisis are having an impact on the activities of our partners. The first, mentioned by 80% of those surveyed, is the increase in inflation in recent months. Thus, the vast majority of the countries where the respondents operate are affected by the significant rise in energy costs and, to a lesser extent, the rise in agricultural product costs. These factors, closely linked to the outbreak of war in Ukraine, therefore have a global impact. Our partners in sub-Saharan Africa are also noting the difficulties in obtaining supplies from abroad in the current context, reinforcing fears of a food crisis.

This survey clearly shows that, from now on, factors other than the COVID-19 crisis are having an impact on the activities of our partners. The first, mentioned by 80% of those surveyed, is the increase in inflation in recent months. Thus, the vast majority of the countries where the respondents operate are affected by the significant rise in energy costs and, to a lesser extent, the rise in agricultural product costs. These factors, closely linked to the outbreak of war in Ukraine, therefore have a global impact. Our partners in sub-Saharan Africa are also noting the difficulties in obtaining supplies from abroad in the current context, reinforcing fears of a food crisis.

Beginning of May 2022, The Europe and Central Asia region stood out for its exposure to other economic difficulties. 50% of respondents in the region indicated that their country was facing rising interest rates, 25% reported local currency tensions (partially resolved at the time of writing), 21% highlighted reduced foreign capital flows, and 17% indicated a decline in remittances from abroad. Currency tensions appear much stronger in Central Asian countries than in Europe. A situation of local currency devaluation was noted by 83% of Central Asian MFIs (6% for European MFIs), and 50% reported a reduction in capital flows and remittances (compared to 11% and 6% respectively for European MFIs).

Finally, let us clarify that Some microfinance institutions note a deterioration in the security situation in their countries, particularly in sub-Saharan Africa (Burkina Faso, Mali, South Africa), in Southeast Asia (Myanmar, Indonesia) and in Palestine. Although these results are not covered in depth here, our partners confirm these issues and their impact on their activities.

- Consequences for MFIs and their clients

The macroeconomic factors presented above negatively affect microfinance institutions. At the time of responding to the survey, 50% of them indicated that they were already feeling their first effects, including 65% of those located in the ECA zone – although some (Lithuania, Kosovo and Bosnia and Herzegovina) did not express such feelings. The main consequence so far, mentioned by 39% of the affected MFIs, is the compression of their financial margin, which is explained largely by the increase in financing costs over the last few months, experienced by 32% of the respondents. This increase comes mainly from the cost of currency hedging on international loans but also from the reduction of local hedging possibilities and access to local financing.

“The quotes offered for MDL financing remain too expensive” – Partner in Moldova

Although this has not yet materialized at the time of this survey, MFIs also indicate that they fear an increase in costs in the coming months that was not budgeted for at the beginning of the year.

“The increase in fuel prices affects the institution’s expenses.” – Partner in Togo

Only a few MFIs cite the increase in the portfolio at risk or the decrease in demand as immediate effects of the international context. However, this is a possibility in the coming months: 71% of them (all areas combined) estimate the probability of deterioration to be high, although it is still too early to estimate it. And if this were to materialize, the origin would come directly from customers finding themselves in a more difficult situation, notably due to a contraction of their disposable income and their repayment capacity in the face of the increased cost of food and energy.

“We could be affected by the impact of the economic situation on the economic health of our customers” – Partner in Romania

“[We could be affected by] the increase in the cost of bread, due to the cost of sourcing wheat flour” – Partner in Burkina Faso

So, even though the situation is so far well understood and seems to be under control by our partners with appropriate measures, weak signals of real difficulties in waiting are clearly perceived. It seems that they are announcing a negative impact on their customers in the medium and long term..

Finally, let us note the humanitarian actions deployed from the first days of the outbreak of hostilities by certain MFIs in Central and Eastern Europe, which participated in the reception or emergency aid of Ukrainian refugees (Moldova, Lithuania, Romania, Kosovo).

“Using company funds, basic necessities were purchased and donated to refugees. Also, while some of our employees donated food, clothing, or money, others, especially young people, decided to become volunteers. It is worth mentioning that in the last month, the institution hired a refugee who decided to stay longer in Moldova as part of our IT team.” – Partner in Moldova

[1] Articles available here: //www.gca-foundation.org/observatoire-covid-19/ And //www.inpulse.coop/news-and-media/

[2] Number of responding MFIs by region: EAC: 24 MFIs; SSA 16 MFIs; SSEA 6 MFIs; MENA: 1 MFI.