36,6 M€

Wallet

35 798

Number of beneficiaries

77,5 %

Women beneficiaries

77 %

Rural beneficiaries

Cambodia

Financial services

Funding granted

Loan of €3 million *

(local currency equivalent)

Partner of the Foundation

since 2010

*Outstanding at grant value

Context :

Cambodia's economy has been growing rapidly since the mid-1990s. The primary sector remains a significant contributor to the economy, despite the rise of the tertiary sector following the arrival of tourism. Fishing and agriculture alone employ 70,000 people.

The company:

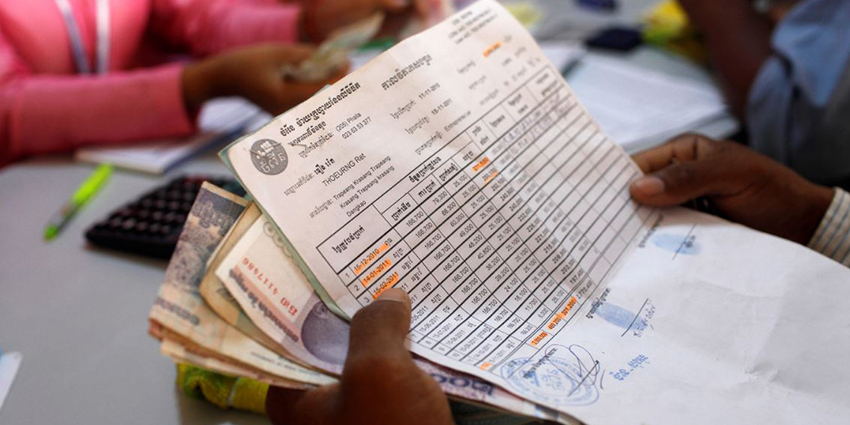

Chamroeun is a Cambodian microfinance institution that places social responsibility at the heart of its business model. It provides financial services to the poorest, who are excluded from the services offered by more commercial microfinance institutions.

Impact :

In order to maximize the impact of credit and effectively assist very poor families, in addition to the financial aspect, Chamroeun also offers a range of training and economic, social and personal support services.

Survey on Financial Inclusion of People with Disabilities in Cambodia

In Cambodia, at least 101,000 people with disabilities suffer from some form of disability and often experience social and economic exclusion and stigma. Strengthening their ability to access financial services can help break the cycle between disability and poverty. In this context, a study was conducted by Chamroeun Microfinance Plc and Good Return to better understand the needs and barriers faced by people with disabilities in accessing financial services.

The study's findings demonstrate the link between disability and exclusion and the untapped opportunities to break this cycle. While only 30% of the 513 respondents have used financial services, more than 50% are considering a loan in the future, primarily for entrepreneurial activities, and 90% see the benefits of financial education training.

This study will contribute to structuring the “Education and Access: Responsible Service for People with Disabilities” project of the Australia-Cambodia Cooperation Program for Equitable Sustainable Services (ACCESS) which aims to improve access to responsible finance for people with disabilities.

Supported by the Grameen Crédit Agricole Foundation since 2010, Chamroeun Microfinance Plc is a Cambodian microfinance institution that provides financial services to the poorest populations, as well as training and support services. It currently serves nearly 43,000 clients, of whom 81% are women and 65% live in rural areas.

Access the study (in English) here

Chamroeun, a partner of the Foundation, obtains Smart Certification

The Smart Campaign, a global initiative to integrate customer protection principles into the financial inclusion sector, has publicly recognized Chamroeun, a partner of the Grameen Crédit Agricole Foundation since 2010, for its customer protection efforts by awarding it Certification. The institution joins more than 115 other financial inclusion organizations in over 40 countries that have been certified since the program's launch in January 2013.

“We extend our sincere congratulations to Chamroeun,” said Isabelle Barrès, Director of the Smart Campaign. “Its willingness to do the necessary work to prepare for and undergo the intensive assessment process is a testament to its deep commitment to its clients. The institution has shown that achieving this goal in the area of client protection is possible. Its example will catalyze a movement toward certification within the broader industry.”

The Smart Campaign's Customer Protection Certification Program publicly recognizes institutions that provide financial services to low-income households and whose treatment standards meet the Smart Campaign's seven Customer Protection Principles. These principles cover important areas such as pricing, transparency, fair and respectful treatment, and the prevention of over-indebtedness. The certification program includes a set of rigorous standards against which institutions are assessed by independent third-party assessors accredited by the Smart Campaign. The assessors are specialized rating agencies with extensive experience and have analyzed hundreds of institutions to date.

Chamroeun has a long-standing commitment to protecting its customers. Before being certified, the Smart Campaign assessed the institution's practices and helped develop the Campaign's tools to advance the industry.

For more information about Chamroeun, click here.

The Foundation grants a loan of €330,000 to Chamroeun in Cambodia

The Grameen Crédit Agricole Foundation has granted a two-year loan of €330,000 to the Chamroeun microfinance institution in Cambodia. The Grameen Crédit Agricole Foundation has granted a two-year loan of €330,000 to the Chamroeun microfinance institution in Cambodia, in which it has been a shareholder since 2012, amounting to 20%. With this new loan, the Foundation's cumulative investment in this social enterprise stands at €1.6 million as of the end of December 2017.

Chamroeun is a microfinance institution that places social vocation at the heart of its business model. It provides financial services to the poorest, excluded from the services offered by more commercial microfinance institutions. To maximize the impact of credit and effectively assist very poor families, it also offers them a range of training and economic, social, and personal support services. As of the end of September 2017, the institution had 24,530 active clients, including 811 TP3T, with an average loan granted to its clients equivalent to 315 euros.

___________________________________________________________

Created in 2008, under the joint leadership of Crédit Agricole SA's management and Professor Yunus, 2006 Nobel Peace Prize winner and founder of Grameen Bank, the Grameen Crédit Agricole SA Foundation is a multi-sector operator that contributes to the fight against poverty through financial inclusion and social impact entrepreneurship. As an investor, lender, technical assistance coordinator, and fund advisor, the Foundation supports microfinance institutions and social enterprises in nearly 40 countries.

Four new investments in Asia for the Foundation

The Grameen Crédit Agricole Foundation has just made four new investments in Asia, including a new partner in India. To date, the Foundation has 16 partners in Asia with a portfolio of €25 million.

Thus, in partnership with CA CIB India, the Foundation granted a guarantee equivalent to €5 million to the Indian microfinance institution Annapurna, for a loan granted by CA CIB India in local currency. Annapurna Finance Pvt. Ltd (AFPL) was established in 2009 and is now among the top ten NBFC MFIs in the country. The institution was established with the aim of serving economically backward clients by bringing them into integration, by providing needs-based financial services at their doorsteps. Its main objectives are to provide financial assistance for economic empowerment, offer tailor-made and needs-based products to meet all the needs of the clients' life cycle, and prioritize women and involve them directly in productive activities through self-help groups and access to finance, in order to create additional income opportunities. To date, the institution serves 1.6 million active borrowers, including 99% women and 85% rural borrowers.

Similarly, in Myanmar, the Foundation granted a new loan in local currency equivalent to €2.3 million over a four-year period to VisionFund Myanmar, a microfinance institution that lends small amounts of money to individuals who lack a measurable credit history, assets to secure loans, or access to traditional sources of financing. To date, VisionFund Myanmar has more than 190,000 clients, including 86% women and 59% clients in rural areas.

Also in Myanmar, the Foundation also granted a new loan in local currency equivalent to €1.8 million over a four-year period to the microfinance institution Proximity Designs on behalf of Proximity Finance, a microfinance program whose objective is to eradicate extreme poverty by treating the poor as clients. To date, the program has 117,000 clients, including 69% women.

Finally, in Cambodia, the Foundation granted a loan equivalent to €1.6 million to Chamroeun, a long-standing partner of the Foundation since 2010. Chamroeun is a microfinance institution that provides financial services to the poorest, excluded from the services offered by more commercial microfinance institutions. The institution serves more than 30,000 clients, including 821,000 women.

More information about the Foundation's partners here.

A successful first year for the Solidarity Bankers program

At the initiative of the Grameen Crédit Agricole Foundation and Crédit Agricole SA, skills-based volunteering missions labeled "Solidarity Banker" are offered to Crédit Agricole Group employees on behalf of microfinance institutions or social impact companies supported by the Foundation.

Senegal, Morocco, Haiti…: a great success for the first year

Less than a year after its launch in 2018, the program's success confirms employees' commitment and willingness to support social impact projects. This is the first time a partnership of this type has been launched by Crédit Agricole and the Grameen Crédit Agricole Foundation. The objective is twofold: first, to promote the skills of Crédit Agricole Group employees and second, to provide additional support to the Foundation's partner microfinance institutions and companies with one- to two-week field missions.

In 2018, six missions were launched, three of which were completed in 2018 and three planned for 2019. To date, four missions are already available for the third quarter of 2019. In 2018, six missions were launched, three of which were completed in 2018 and three planned for 2019. For example, a mission took place in Cambodia with the support of Crédit Agricole's International Retail Bank (BPI), to support the human resources management of Chamroeun, a partner microfinance institution that serves more than 27,500 clients. Another mission was conducted in Senegal, in partnership with Crédit Agricole Franche-Comté, for the Laiterie du Berger, a social enterprise in which the Foundation is a shareholder. Furthermore, with the support of the Regional Fund, the Solidarity Banker who carried out the mission left for 2 years to support Kossam, the Dairy project to structure the milk sector in Senegal.

A mission launched in 2018 will be carried out in July 2019 in cooperation with Crédit du Maroc and Crédit Agricole SA to improve the Al Karama Foundation's anti-money laundering and counter-terrorist financing (AML-CFT) systems. The institution currently supports more than 26,200 clients in Morocco. Another mission launched in 2018 will be carried out in Haiti to support Palmis Enèji, a social enterprise that offers clean and accessible cooking and lighting solutions to Haitian households. Crédit Agricole Corporate Investment Bank is supporting the Solidarity Banker, which will carry out the entire mission through skills sponsorship.

Cambodia, Kenya, Tajikistan… in 2019 the program changes scale

To date, six missions have been launched in 2019. One mission is for Kossam, the Laiterie du Berger project that aims to develop a sustainable dairy sector in Senegal. The Solidarity Banker will be tasked with supporting Kossam in the deployment of a digital application called "commcare collection." Another mission is planned to support the financial management and organizational structure of Cirque Phare (PPSE) in Cambodia. PPSE aims to promote social inclusion and youth empowerment through Cambodian culture and arts. Another mission will be for ACRE Africa, which offers crop insurance services to smallholder farmers. The Solidarity Banker will be tasked with analyzing the organization's new business strategy.

For these first missions launched in 2019, the selection process for Solidarity Bankers has been finalized. To date, three new missions are available: a "business model" role for the microfinance institution Humo in Tajikistan, a "Management Control" role to support the Musoni institution in Kenya, and a "digital" role to support the social enterprise SFA in Senegal.

Other missions are currently being planned with the support of Crédit Agricole Group entities and regional banks. With this initiative, the Group reaffirms its commitment to supporting employee solidarity initiatives and working alongside the Foundation to promote more inclusive and sustainable finance.

For more information, Click here.