5,9M€

Wallet

3 429

Number of beneficiaries

48,1%

Women beneficiaries

51,9 %

Rural beneficiaries

Montenegro

Financial services

Funding granted

Loan of €900,000M*

(local currency equivalent)

Foundation Partner

since 2017

*Outstanding at grant value

Context :

Montenegro's economy is primarily based on agriculture and livestock; 60,131 people are estimated to be employed in the primary sector. The rural population in Montenegro is 33,191 people (2018).

The company:

Founded in 2005, Monte Crédit is a Tier 3 microfinance institution. Its mission is to empower rural families to create income and jobs, unlocking economic potential for communities to prosper.

Impact :

Monte Credit's main activity is to provide economic and financial support to the most vulnerable members of the population in underdeveloped regions of Montenegro and to create sustainable entrepreneurial activities, with the aim of fostering long-term growth and development.

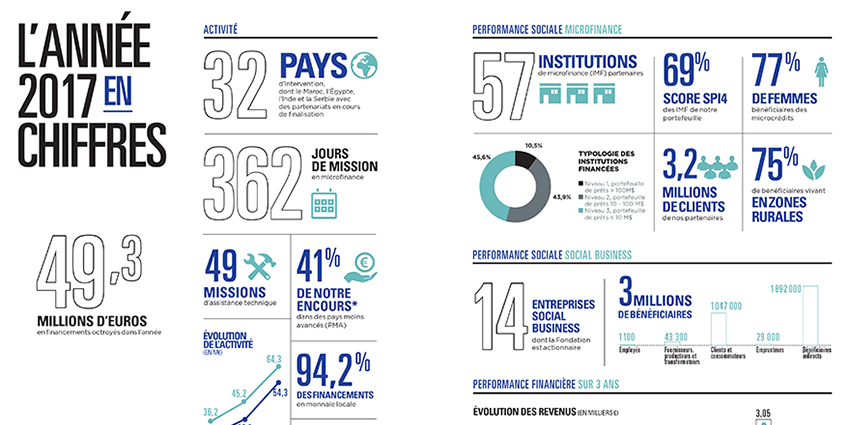

The Grameen Crédit Agricole Foundation posted a good performance in 2017

Since its creation in 2008, the Foundation has committed nearly €200 million in financing. It works with 70 microfinance institutions and social businesses in 28 countries. Women and rural populations represent 76% and 81% of the more than 3 million clients of the institutions that the Foundation supports both in financing and technical assistance. In this support component, the Foundation's teams have led 50 technical assistance missions for 16 partner institutions.

2017 was a year of growth, with positive operating income and a net profit that was also positive, while maintaining a risk profile with no adverse trends. The Foundation thus demonstrated its ability to combine social performance and economic balance. During this year, we refocused on our core business while increasing our capacity to act. In 2017, 44 financing applications were presented to the Investment Committee, for an additional amount of nearly €50 million.

The Foundation has expanded its scope of operations with new partnerships in Montenegro, Kazakhstan, and Burma. 86% of our countries of operation are among the poorest in the world. 48% of funding applications are concentrated in sub-Saharan Africa and 23% in South and Southeast Asia; these two geographic areas each represent 35% of the Foundation's commitments at the end of the year.

Meeting on March 6 and 7 in Luxembourg, the Foundation's directors expressed their satisfaction and congratulated the Foundation's teams for these results, which honor the Institution. The Board of Directors meeting was also an opportunity to outline the avenues for the next medium-term plan for 2019-2023 and to launch a project to create an Investment Fund designed to improve the operational excellence and resilience of our partners.

Committing alongside microfinance institutions, participating in the growth of rural economies, seeing further, acting together for a better shared economy, the Grameen Crédit Agricole Foundation remains focused, humble but active and bold in the service of its founding mission of fighting poverty.

In 2017, the Grameen Crédit Agricole Foundation continued its growth

© Philippe Lissac

At the end of December 2017, the Grameen Crédit Agricole Foundation had recorded €64.1 million in commitments, including €57.5 million in financing to microfinance institutions and €4.8 million in investments in social businesses, representing a year-on-year increase of €451 million. In 2017, 44 funding applications were approved for a total of €49.3 million. Since its creation in 2008, the Foundation has granted 250 financings for a cumulative amount of €196.5 million.

The Foundation has expanded its area of intervention with new partnerships in Montenegro, Kazakhstan, and Burma. It now has 69 active partners and operates in 28 countries, 86% of which are among the world's poorest. 48% of the funding is concentrated in sub-Saharan Africa and 23% in South and Southeast Asia; these two geographic areas each account for 35% of the Foundation's commitments at the end of the year. Women and rural populations represent 76% and 81% of the 3 million clients of the institutions funded by the Foundation. The average loan they grant is around 550 euros.

In 2018, the Foundation will continue its development in new countries by seeking to expand its network of partners whose commonality will continue to be a high level of social performance, the financial autonomy of women and the economic development of rural areas.

The Foundation makes its first investment in Montenegro

The Grameen Crédit Agricole Foundation has made its first investment in Montenegro by granting a €500,000 loan over a three-year period to the microfinance institution Monte Credit, which belongs to Agroinvest Holding, a subsidiary of Vision Fund International.

Monte Credit Montenegro's target clients are poor households, those engaged in small business activities, microenterprises in the areas of trade, agricultural production/processing/sales, and small and medium-sized tourism-oriented businesses. Monte Credit primarily offers its clients agricultural loans and loans for business activities, using the individual lending methodology.

With this new loan, the Foundation now has 14 partners in the Eastern Europe and Central Asia region, representing 25% of its microfinance partners, for a total amount of commitments at the end of 2017 of 16 million euros in the region.

___________________________________________________________

Created in 2008, under the joint leadership of Crédit Agricole SA's management and Professor Yunus, 2006 Nobel Peace Prize winner and founder of Grameen Bank, the Grameen Crédit Agricole SA Foundation is a multi-sector operator that contributes to the fight against poverty through financial inclusion and social impact entrepreneurship. As an investor, lender, technical assistance coordinator, and fund advisor, the Foundation supports microfinance institutions and social enterprises in nearly 40 countries.

The Foundation continues its investments in Europe and Central Asia

In recent months, the Grameen Crédit Agricole Foundation has continued to expand its portfolio with new investments in Eastern Europe and Central Asia.

It has thus granted a new loan to the microfinance institution Monte Credit in Montenegro, for an amount of 1 million euros over a period of 3 years. Monte Credit offers its clients mainly agricultural loans and loans for commercial activities, using the individual lending methodology. To date, the institution, which manages a portfolio of 7.4 million euros, has 4,600 clients, including 55% women. 56% of its clients are located in rural areas.

The Foundation also granted two new loans totaling €2.5 million to the Georgian microfinance institution Lazika, whose mission is to facilitate access to financial services tailored to entrepreneurs. With a portfolio of €14 million, the institution now has approximately 11,000 clients, including 471,000 women and 751,000 clients in rural areas.

Finally, the Foundation granted a new three-year loan to OXUS Tajikistan for €1.2 million. OXUS Tajikistan is a microfinance institution focused on operations in rural areas, where more than 80,000 of its clients live and work. To date, the institution has 14,000 clients, including 39,000 women, and manages a portfolio worth €11.3 million.

With these new investments, the Foundation now has 16 partners spread across 7 countries in the region, representing a portfolio of outstanding loans of 16.6 million euros, or 19.81% of the total amount of outstanding loans managed by the Foundation at the end of October.